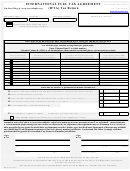

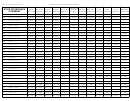

Form Gas-1276 - International Fuel Tax Agreement (Ifta) Return Page 3

ADVERTISEMENT

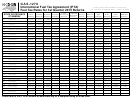

Pat McCrory

Jeffrey M. Epstein

Governor

Secretary

Excise Tax Division

North Carolina Department of Revenue

Post Office Box 25000

Raleigh, North Carolina 27640-0001

IMPORTANT NOTICE:

IFTA Taxpayers with a Base Jurisdiction State

Other than North Carolina

st

The North Carolina Department of Revenue had a tax rate change for the 1

Quarter of

st

2016. Unfortunately, the update to the IFTA, Inc. 1

Quarter Tax Matrix did not reflect

North Carolina’s reduced tax rate.

Therefore, a tax rate of $0.36 per gallon was

st

erroneously listed in the IFTA, Inc. 1

Quarter Matrix.

When notified of the incorrect rate, some IFTA Jurisdictions were unable to adjust the

tax rate for North Carolina in their automated systems.

Please file and pay your IFTA quarterly tax return with your base jurisdiction as you

would any other quarterly return. Do not delay in filing and paying your quarterly return

beyond the due date, as this may result in penalties and/or interest.

The North Carolina Department of Revenue, Excise Tax Division is working with affected

IFTA Jurisdictions, who are aware of this tax rate issue, to ensure any overpayments or

underpayments that occur as a result of the erroneous tax rate are addressed

appropriately.

We apologize for any inconvenience or confusion this may cause. If you have further

questions, please feel free to contact the North Carolina Excise Tax Division at

telephone number (919) 707-7500 or toll free at (877) 308-9092.

Issued April 22, 2016

P.O. Box 25000, Raleigh, North Carolina 27602-0871

State Courier 51-71-00

Website:

An Equal Opportunity Employer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

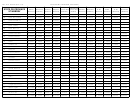

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13