Taxes And Fees Administered By The California State Board Of Equalization 2005-2006

ADVERTISEMENT

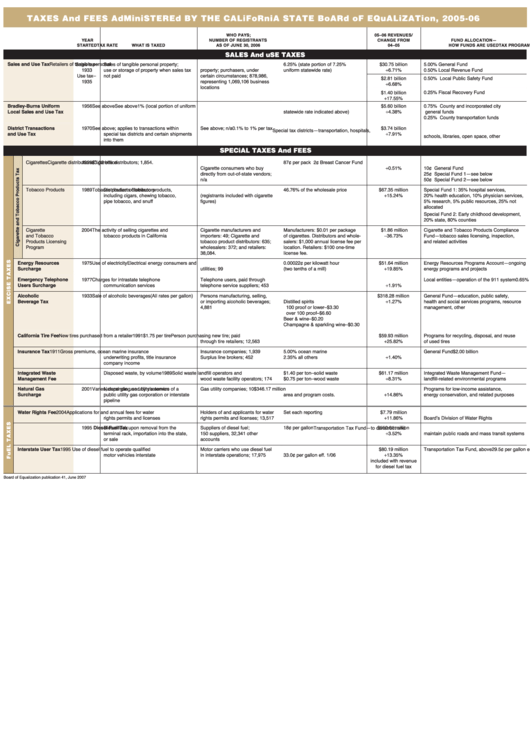

TaxEs and FEEs adminisTErEd by ThE caliFornia sTaTE board oF EqualizaTion, 2005-06

WHO PAYS;

05–06 REVENUES/

YEAR

NUMBER OF REGISTRANTS

CHANGE FROM

FUND ALLOCATION—

TAX PROGRAM

STARTED

WHAT IS TAXED

AS OF JUNE 30, 2006

TAX RATE

04–05

HOW FUNDS ARE USED

salEs and usE TaxEs

Sales and Use Tax

Sales tax–

Sales of tangible personal property;

Retailers of tangible personal

6.25% (state portion of 7.25%

$30.75 billion

5.00%

General Fund

1933

use or storage of property when sales tax

property; purchasers, under

uniform statewide rate)

0.50%

Local Revenue Fund

+6.71%

Use tax–

not paid

certain circumstances; 878,986,

$2.81 billion

0.50%

Local Public Safety Fund

1935

representing 1,069,106 business

+6.68%

locations

0.25%

Fiscal Recovery Fund

$1.40 billion

+17.55%

Bradley-Burns Uniform

1956

See above

See above

1% (local portion of uniform

$5.60 billion

0.75%

County and incorporated city

Local Sales and Use Tax

statewide rate indicated above)

general funds

+4.38%

0.25%

County transportation funds

District Transactions

1970

See above; applies to transactions within

See above; n/a

0.1% to 1% per tax

$3.74 billion

Special tax districts—transportation, hospitals,

and Use Tax

special tax districts and certain shipments

+7.91%

schools, libraries, open space, other

into them

spEcial TaxEs and FEEs

Cigarettes

1959

Cigarette distributions

Cigarette distributors; 1,854.

87¢ per pack

$1.02 billion

2¢

Breast Cancer Fund

Cigarette consumers who buy

10¢

General Fund

+0.51%

directly from out-of-state vendors;

25¢

Special Fund 1—see below

n/a

50¢

Special Fund 2—see below

Tobacco Products

1989

Distribution of tobacco products,

Tobacco products distributors

46.76% of the wholesale price

$67.35 million

Special Fund 1: 35% hospital services,

including cigars, chewing tobacco,

(registrants included with cigarette

20% health education, 10% physician services,

+15.24%

pipe tobacco, and snuff

figures)

5% research, 5% public resources, 25% not

allocated

Special Fund 2: Early childhood development,

20% state, 80% counties

Cigarette

2004

The activity of selling cigarettes and

Cigarette manufacturers and

Manufacturers: $0.01 per package

$1.86 million

Cigarette and Tobacco Products Compliance

and Tobacco

tobacco products in California

importers: 49; Cigarette and

of cigarettes. Distributors and whole-

Fund—tobacco sales licensing, inspection,

−36.73%

Products Licensing

tobacco product distributors: 635;

salers: $1,000 annual license fee per

and related activities

Program

wholesalers: 372; and retailers:

location. Retailers: $100 one-time

38,084.

license fee.

Energy Resources

1975

Use of electricity

Electrical energy consumers and

0.00022¢ per kilowatt hour

$51.64 million

Energy Resources Programs Account—ongoing

Surcharge

utilities; 99

(two tenths of a mill)

energy programs and projects

+19.85%

Emergency Telephone

1977

Charges for intrastate telephone

Telephone users, paid through

0.65% of charges for services

$130.916 million

Local entities—operation of the 911 system

Users Surcharge

communication services

telephone service suppliers; 453

+1.91%

Alcoholic

1933

Sale of alcoholic beverages

Persons manufacturing, selling,

(All rates per gallon)

$318.28 million

General Fund—education, public safety,

Beverage Tax

or importing alcoholic beverages;

Distilled spirits

health and social services programs, resource

+1.27%

4,881

100 proof or lower–$3.30

management, other

over 100 proof–$6.60

Beer & wine–$0.20

Champagne & sparkling wine–$0.30

California Tire Fee

1991

New tires purchased from a retailer

Person purchasing new tire; paid

$1.75 per tire

$59.93 million

Programs for recycling, disposal, and reuse

through tire retailers; 12,563

of used tires

+25.82%

Insurance Tax

1911

Gross premiums, ocean marine insurance

Insurance companies; 1,939

5.00% ocean marine

$2.00 billion

General Fund

underwriting profits, title insurance

Surplus line brokers; 452

2.35% all others

+1.40%

company income

Integrated Waste

1989

Disposed waste, by volume

Solid waste landfill operators and

$1.40 per ton–solid waste

$61.17 million

Integrated Waste Management Fund—

Management Fee

wood waste facility operators; 174

$0.75 per ton–wood waste

landfill-related environmental programs

+8.31%

Natural Gas

2001

Natural gas used by customers of a

Gas utility companies; 10

Varies, depending on utility’s service

$346.17 million

Programs for low-income assistance,

Surcharge

public utility gas corporation or interstate

area and program costs.

energy conservation, and related purposes

+14.86%

pipeline

Water Rights Fee

2004

Applications for and annual fees for water

Holders of and applicants for water

Set each reporting period.

$7.79 million

Operation of the State Water Resources Control

rights permits and licenses

rights permits and licenses; 13,517

Board’s Division of Water Rights

+11.86%

Diesel Fuel Tax

18¢ per gallon

1995

Diesel fuel, upon removal from the

Suppliers of diesel fuel;

$550.81 million

Transportation Tax Fund—to construct and

terminal rack, importation into the state,

150 suppliers, 32,341 other

maintain public roads and mass transit systems

+3.52%

or sale

accounts

Interstate User Tax

1995

Use of diesel fuel to operate qualified

Motor carriers who use diesel fuel

29.5¢ per gallon eff. 1/05

$80.19 million

Transportation Tax Fund, above

motor vehicles interstate

in interstate operations; 17,975

33.0¢ per gallon eff. 1/06

+13.35%

included with revenue

for diesel fuel tax

Board of Equalization publication 41, June 2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2