Taxes And Fees Administered By The California State Board Of Equalization 2005-2006 Page 2

ADVERTISEMENT

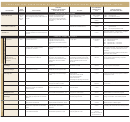

TaxEs and FEEs adminisTErEd by ThE caliFornia sTaTE board oF EqualizaTion, 2005-06

WHO PAYS;

05–06 REVENUES/

YEAR

NUMBER OF REGISTRANTS

CHANGE FROM

FUND ALLOCATION—

TAX PROGRAM

STARTED

WHAT IS TAXED

AS OF JUNE 30, 2006

TAX RATE

04–05

HOW FUNDS ARE USED

spEcial TaxEs and FEEs (continued)

Use Fuel Tax

1937

Vehicular use of liquid natural gas,

Owners and operators of

6–18¢ per gallon of fuel (varies by

Included in revenue

Transportation Tax Fund, above

compressed natural gas (CNG), and

vehicles powered by covered

type), 7¢ per 100 cubic feet of CNG,

for diesel fuel tax

certain other fuels

fuels, use fuel vendors; 1,060

or annual fee based on vehicle weight

Motor Vehicle

2002

Gasoline, upon removal from the terminal

Gasoline suppliers; 119 suppliers,

18¢ per gallon

$2.87 billion

Transportation Tax Fund—to construct and

1

Fuel Tax

132 other accounts

rack, importation into the state, or sale

maintain public roads and mass transit

+0.34%

systems

Aircraft Jet Fuel Tax

1969

Sales of jet fuel to jet fuel users

Jet fuel dealers; 218

2¢ per gallon

$3.12 million

State Transportation Fund, Aeronautics

Account—airport programs

+21.35%

Underground

Owners of underground fuel

1989

Storage of petroleum products in

1.3¢ per gallon through 12/05

$241.57 million

Program that ensures cleanup of leaking

Storage Tank

underground tanks

storage tanks; 6,862

1.4¢ per gallon eff. 1/06

underground petroleum storage tanks

+10.82%

Maintenance Fee

Childhood Lead

1993

Motor vehicle fuel; architectural coatings;

The petroleum industry, the

Reestablished each reporting period

$9.97 million

Lead poisoning prevention program

Poisoning Prevention

lead releases into California air

architectural coatings industry,

for children

−16.24%

Fee

and facilities reporting releases

of lead into the air; 941

Oil Spill

Marine pipeline operators;

1991

Crude oil and petroleum products received

5¢ per barrel eff.1-20-03

$28.76 million

Oil spill prevention programs and studies

Prevention and

at marine terminals in California or moved

owners of crude oil and

of spill effects, prevention, and response

+4.37%

Administration

through pipelines

petroleum products received

Fee

at marine terminals; 33

Oil Spill

1991

Petroleum products received at marine

Owners of petroleum products

25¢ per barrel

No fees collected

Oil Spill Response Trust Fund—pays for

Response

received at marine terminals,

terminals, moved through pipelines, or

in 2005–06;

response to and cleanup of marine oil spills;

Fee

received at refineries

marine pipeline operators, oil

$50 million Oil Spill

related wildlife care; spill-related damages

refineries, marine pipelines; 28

Response Trust

Fund is at maximum

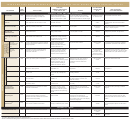

Environmental Fee

1989

Activity by certain types of corporations

Corporations with at least

$250–$11,952 per year, based on

$31.70 million

Cleanup of contaminated sites

50 employees, in industry groups

number of workers employed in

+3.42%

that use, generate, store, or

California more than 500 hours

conduct activities relating to

annually

hazardous materials; 42,581

Activity Fee

1989

Applications and modification requests for

Hazardous waste activity

Varies according to activity

$0.71 million

Regulation of hazardous waste

hazardous waste permits

applicants; n/a

requested

management

+56.80%

Generator Fee

1986

Generation of hazardous waste at a

Generators of hazardous waste

$177–$70,660, based on amount of

$22.46 million

See above

specific site

who do not pay a facility fee;

waste generated

−3.13%

6,578

Disposal Fee

Hazardous waste disposed of by depositing

Hazardous waste disposal

1985

Rates per ton vary, depending

$6.58 million

See above

on or into land

facilities; 10

on waste category, volume, and

+11.47%

disposal method

Facility Fee

1986

Storage, treatment, or disposal of

Hazardous waste facility

Varies according to size and type

$4.75 million

See above

operators; 217

hazardous waste

of facility

−7.12%

Occupational

Industrial activity by employers in certain

Employers with 10 or more

1991

$258–$2,958 per year, based on

$3.09 million

Occupational lead poisoning prevention

Lead Poisoning

industrial classifications

employees in industries with

number of employees and industrial

program

+3.21%

Prevention Fee

documented evidence of poten-

classification

tial occupational lead poisoning;

16,530

Electronic Waste

Certain new or refurbished televisions,

Retailers of new or refurbished

This fee ranges from $6.00 to $10.00

$78.32 million

The fee was established to fund electronic

2005

Recycling Fee

computer monitors, laptop computers,

CEDs; 20,000

imposed on the retail sale to

waste recycling programs and over time,

+154.24%

and other devices (referred to as Covered

consumers. The fee is based upon

reduce the amount of hazardous waste in

Electronic Devices (CEDs))

the viewable size of the video display,

landfills

measured diagonally.

Marine Invasive

Ships entering California with ballast water

Owners and operators of vessels

$3.00 million

Program that addresses the introduction of

$400 per qualifying vessel voyage

2000

Species Fee

from outside a defined coastal zone

arriving in California ports; 3,039

non-native aquatic species into the state’s

2

−14.80%

waters

p r o p E r T y T a x E s

Private Railroad Car Tax

1938

Private railcars operated within California

Railcar owners; 239

1.092% of assessed value

General Fund

$6.95 million

+5.68%

Timber Yield Tax

1977

Timber harvested for forest products

Timber owners; 1,989

2.9% of immediate harvest value

$16.14 million

Distributed to counties where timber was

harvested

+13.16%

Originally the Motor Vehicle Fuel License Tax, implemented in 1941.

1

Known as the Ballast Water Management Fee through December 31, 2003. Administered under the Marine Invasive Species Fee Collection Law, effective January 1, 2004.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2