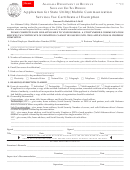

Form Dtf-83 - 2007 - Application For Qualified Empire Zone Enterprise Sales Tax Certification Page 2

ADVERTISEMENT

Page 2 of 4 DTF-83 (1/07)

Step 3

(a) Enter the dates of the last tax year ending before the test date

/

/

/

/

to

determined in Step 1. This is your test year. . ............................................................................

/

/

to

/

/

(b) Enter the dates of the five tax years immediately preceding the test year listed in 3(a),

/

/

to

/

/

above. This is your base period. If you have fewer than five years preceding the test year,

/

/

to

/

/

your base period is the smaller set of years.

/

/

to

/

/

If you do not have a base period, continue with Step 4.

/

/

to

/

/

Step 4

Business enterprises that have no base period must meet the new business test below to qualify

for QEZE sales tax exemptions. If this applies to you, continue below. If not, skip to Step 5.

(a) Is your business entity identical in ownership and operation to an existing business entity in New York State?

(Identical in ownership and operation means that the new business entity has identical ownership to the

existing entity and that the new business operation is the same type of operation as the existing entity.) . .............

Yes

No

• If No, continue with Step 4(b).

• If Yes, is the other business entity operating in a different county in New York State? . .....................................

Yes

No

• If No, then your business entity is identical in ownership and operation to an existing business entity

operating in the same county as your business. You do not qualify as a new business and are not eligible

for QEZE sales tax exemptions. Do not continue to Step 5, and do not submit this application.

• If Yes, please complete either (1) or (2) below (whichever is applicable) and proceed to Step 6.

(1) If the other business entity is not certified with the Tax Department as a QEZE for sales tax purposes,

enter the name, federal employer identification number (EIN) and address of the other business entity:

Other business entity legal name:

Other business entity federal EIN:

Other business entity address:

(2) If the other business entity is certified with the Tax Dept. as a QEZE for sales tax purposes, enter the name, federal EIN,

address, and 7‑digit QEZE number from the other entity’s form DTF‑81, Qualified Empire Zone Enterprise (QEZE) Sales Tax

Certification, issued by the Tax Department. You must also attach a copy of the other business entity’s form DTF‑81. Note: Your

business will be eligible for QEZE sales tax exemptions as of the effective date on your Form DTF‑81, and your benefit period

will extend only for the remainder of the other business entity’s existing benefit period.

Other business entity name:

Other business entity federal EIN:

Other business entity address:

Other business entity 7 digit QEZE sales tax number:

(b) Is your business entity substantially similar in ownership and operation to a business entity taxable, or previously

taxable, under Tax Law, Article 9, section 183, 184, 185, or 186; Article 9‑A, 32, or 33; Article 23 (or that would

have been subject to Article 23 as this article was in effect January 1, 1980); or a business entity for which the

income or losses were included for your taxes under Article 22? ...........................................................................

Yes

No

• If No, mark an X in the New business box at the top of Step 5 and proceed to Step 6.

• If Yes, you do not qualify as a new business and are not eligible for QEZE sales tax benefits. Do not continue

with Step 5, and do not submit this application.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4