Instructions For Form Ic134 Sheet

ADVERTISEMENT

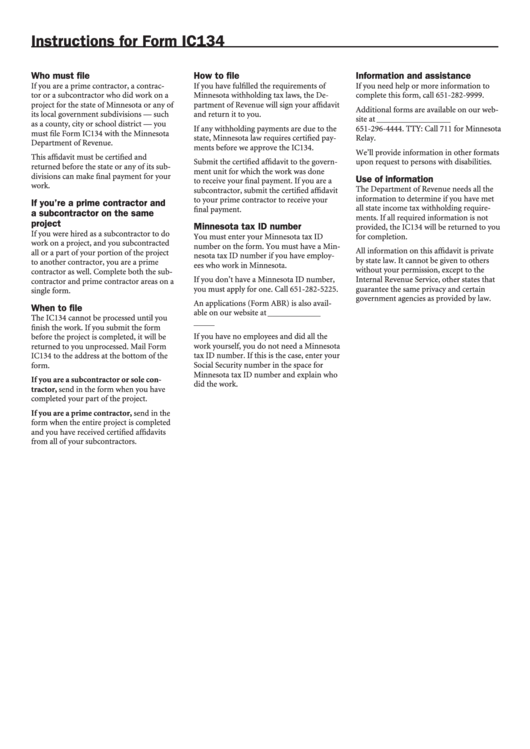

Instructions for Form IC134

Who must file

How to file

Information and assistance

If you are a prime contractor, a contrac-

If you have fulfilled the requirements of

If you need help or more information to

tor or a subcontractor who did work on a

Minnesota withholding tax laws, the De-

complete this form, call 651-282-9999.

project for the state of Minnesota or any of

partment of Revenue will sign your affidavit

Additional forms are available on our web-

its local government subdivisions — such

and return it to you.

site at or by calling

as a county, city or school district — you

If any withholding payments are due to the

651-296-4444. TTY: Call 711 for Minnesota

must file Form IC134 with the Minnesota

state, Minnesota law requires certified pay-

Relay.

Department of Revenue.

ments before we approve the IC134.

We’ll provide information in other formats

This affidavit must be certified and

Submit the certified affidavit to the govern-

upon request to persons with disabilities.

returned before the state or any of its sub-

ment unit for which the work was done

divisions can make final payment for your

Use of information

to receive your final payment. If you are a

work.

The Department of Revenue needs all the

subcontractor, submit the certified affidavit

information to determine if you have met

to your prime contractor to receive your

If you’re a prime contractor and

all state income tax withholding require-

final payment.

a subcontractor on the same

ments. If all required information is not

project

Minnesota tax ID number

provided, the IC134 will be returned to you

If you were hired as a subcontractor to do

You must enter your Minnesota tax ID

for completion.

work on a project, and you subcontracted

number on the form. You must have a Min-

All information on this affidavit is private

all or a part of your portion of the project

nesota tax ID number if you have employ-

by state law. It cannot be given to others

to another contractor, you are a prime

ees who work in Minnesota.

without your permission, except to the

contractor as well. Complete both the sub-

If you don’t have a Minnesota ID number,

Internal Revenue Service, other states that

contractor and prime contractor areas on a

you must apply for one. Call 651-282-5225.

guarantee the same privacy and certain

single form.

government agencies as provided by law.

An applications (Form ABR) is also avail-

When to file

able on our website at

The IC134 cannot be processed until you

mn.us.

finish the work. If you submit the form

If you have no employees and did all the

before the project is completed, it will be

work yourself, you do not need a Minnesota

returned to you unprocessed. Mail Form

tax ID number. If this is the case, enter your

IC134 to the address at the bottom of the

Social Security number in the space for

form.

Minnesota tax ID number and explain who

If you are a subcontractor or sole con-

did the work.

tractor, send in the form when you have

completed your part of the project.

If you are a prime contractor, send in the

form when the entire project is completed

and you have received certified affidavits

from all of your subcontractors.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1