Instructions For Form Mc 338 - 250 Percent Income Test Work Sheet For The 250 Percent Working Disabled Program-Adults

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

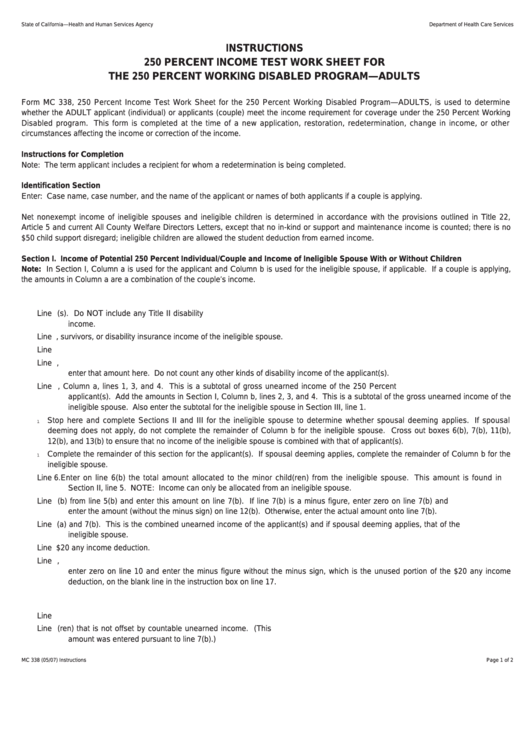

INSTRUCTIONS

250 PERCENT INCOME TEST WORK SHEET FOR

THE 250 PERCENT WORKING DISABLED PROGRAM—ADULTS

Form MC 338, 250 Percent Income Test Work Sheet for the 250 Percent Working Disabled Program—ADULTS, is used to determine

whether the ADULT applicant (individual) or applicants (couple) meet the income requirement for coverage under the 250 Percent Working

Disabled program. This form is completed at the time of a new application, restoration, redetermination, change in income, or other

circumstances affecting the income or correction of the income.

Instructions for Completion

Note: The term applicant includes a recipient for whom a redetermination is being completed.

Identification Section

Enter: Case name, case number, and the name of the applicant or names of both applicants if a couple is applying.

Net nonexempt income of ineligible spouses and ineligible children is determined in accordance with the provisions outlined in Title 22,

Article 5 and current All County Welfare Directors Letters, except that no in-kind or support and maintenance income is counted; there is no

$50 child support disregard; ineligible children are allowed the student deduction from earned income.

Section I. Income of Potential 250 Percent Individual/Couple and Income of Ineligible Spouse With or Without Children

Note: In Section I, Column a is used for the applicant and Column b is used for the ineligible spouse, if applicable. If a couple is applying,

the amounts in Column a are a combination of the couple’s income.

A. Nonexempt Unearned Income

Line 1. Enter any social security retirement and survivors insurance income of the applicant(s). Do NOT include any Title II disability

income.

Line 2. Enter any retirement, survivors, or disability insurance income of the ineligible spouse.

Line 3. Enter any net income from property.

Line 4. Enter all other unearned income. If there is unearned income based on the SSI in-kind support and maintenance requirement,

enter that amount here. Do not count any other kinds of disability income of the applicant(s).

Line 5. Add the amounts in Section I, Column a, lines 1, 3, and 4. This is a subtotal of gross unearned income of the 250 Percent

applicant(s). Add the amounts in Section I, Column b, lines 2, 3, and 4. This is a subtotal of the gross unearned income of the

ineligible spouse. Also enter the subtotal for the ineligible spouse in Section III, line 1.

Stop here and complete Sections II and III for the ineligible spouse to determine whether spousal deeming applies. If spousal

l

deeming does not apply, do not complete the remainder of Column b for the ineligible spouse. Cross out boxes 6(b), 7(b), 11(b),

12(b), and 13(b) to ensure that no income of the ineligible spouse is combined with that of applicant(s).

Complete the remainder of this section for the applicant(s). If spousal deeming applies, complete the remainder of Column b for the

l

ineligible spouse.

Line 6. Enter on line 6(b) the total amount allocated to the minor child(ren) from the ineligible spouse. This amount is found in

Section II, line 5. NOTE: Income can only be allocated from an ineligible spouse.

Line 7. Subtract line 6(b) from line 5(b) and enter this amount on line 7(b). If line 7(b) is a minus figure, enter zero on line 7(b) and

enter the amount (without the minus sign) on line 12(b). Otherwise, enter the actual amount onto line 7(b).

Line 8. Add lines 5(a) and 7(b). This is the combined unearned income of the applicant(s) and if spousal deeming applies, that of the

ineligible spouse.

Line 9. No entry. This shows the $20 any income deduction.

Line 10. Subtract line 9 from line 8. This is the total countable unearned income. If the countable unearned income is a minus figure,

enter zero on line 10 and enter the minus figure without the minus sign, which is the unused portion of the $20 any income

deduction, on the blank line in the instruction box on line 17.

B. Nonexempt Earned Income

Line 11. Enter the gross earned income.

Line 12. This is the amount of any allocation for any ineligible minor child(ren) that is not offset by countable unearned income. (This

amount was entered pursuant to line 7(b).)

MC 338 (05/07) Instructions

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2