Instructions For Form 720 - Quarterly Federal Excise Tax Return - 2010

ADVERTISEMENT

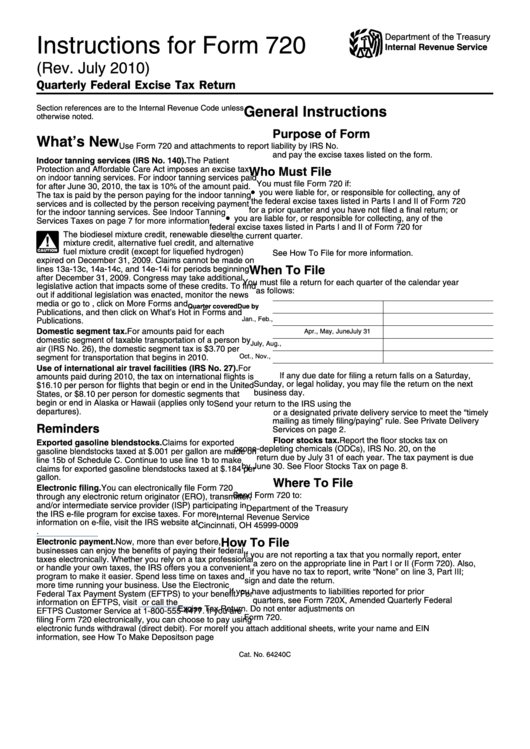

Instructions for Form 720

Department of the Treasury

Internal Revenue Service

(Rev. July 2010)

Quarterly Federal Excise Tax Return

General Instructions

Section references are to the Internal Revenue Code unless

otherwise noted.

Purpose of Form

What’s New

Use Form 720 and attachments to report liability by IRS No.

and pay the excise taxes listed on the form.

Indoor tanning services (IRS No. 140). The Patient

Protection and Affordable Care Act imposes an excise tax

Who Must File

on indoor tanning services. For indoor tanning services paid

You must file Form 720 if:

for after June 30, 2010, the tax is 10% of the amount paid.

•

you were liable for, or responsible for collecting, any of

The tax is paid by the person paying for the indoor tanning

the federal excise taxes listed in Parts I and II of Form 720

services and is collected by the person receiving payment

for a prior quarter and you have not filed a final return; or

for the indoor tanning services. See Indoor Tanning

•

you are liable for, or responsible for collecting, any of the

Services Taxes on page 7 for more information

federal excise taxes listed in Parts I and II of Form 720 for

The biodiesel mixture credit, renewable diesel

the current quarter.

!

mixture credit, alternative fuel credit, and alternative

fuel mixture credit (except for liquefied hydrogen)

See How To File for more information.

CAUTION

expired on December 31, 2009. Claims cannot be made on

When To File

lines 13a-13c, 14a-14c, and 14e-14i for periods beginning

after December 31, 2009. Congress may take additional

You must file a return for each quarter of the calendar year

legislative action that impacts some of these credits. To find

as follows:

out if additional legislation was enacted, monitor the news

media or go to , click on More Forms and

Quarter covered

Due by

Publications, and then click on What’s Hot in Forms and

Jan., Feb., Mar.

April 30

Publications.

Domestic segment tax. For amounts paid for each

Apr., May, June

July 31

domestic segment of taxable transportation of a person by

July, Aug., Sept.

October 31

air (IRS No. 26), the domestic segment tax is $3.70 per

Oct., Nov., Dec.

January 31

segment for transportation that begins in 2010.

Use of international air travel facilities (IRS No. 27). For

If any due date for filing a return falls on a Saturday,

amounts paid during 2010, the tax on international flights is

Sunday, or legal holiday, you may file the return on the next

$16.10 per person for flights that begin or end in the United

business day.

States, or $8.10 per person for domestic segments that

begin or end in Alaska or Hawaii (applies only to

Send your return to the IRS using the U.S. Postal Service

departures).

or a designated private delivery service to meet the “timely

mailing as timely filing/paying” rule. See Private Delivery

Reminders

Services on page 2.

Floor stocks tax. Report the floor stocks tax on

Exported gasoline blendstocks. Claims for exported

ozone-depleting chemicals (ODCs), IRS No. 20, on the

gasoline blendstocks taxed at $.001 per gallon are made on

return due by July 31 of each year. The tax payment is due

line 15b of Schedule C. Continue to use line 1b to make

by June 30. See Floor Stocks Tax on page 8.

claims for exported gasoline blendstocks taxed at $.184 per

gallon.

Where To File

Electronic filing. You can electronically file Form 720

Send Form 720 to:

through any electronic return originator (ERO), transmitter,

and/or intermediate service provider (ISP) participating in

Department of the Treasury

the IRS e-file program for excise taxes. For more

Internal Revenue Service

information on e-file, visit the IRS website at

Cincinnati, OH 45999-0009

/efile.

How To File

Electronic payment. Now, more than ever before,

businesses can enjoy the benefits of paying their federal

If you are not reporting a tax that you normally report, enter

taxes electronically. Whether you rely on a tax professional

a zero on the appropriate line in Part I or II (Form 720). Also,

or handle your own taxes, the IRS offers you a convenient

if you have no tax to report, write “None” on line 3, Part III;

program to make it easier. Spend less time on taxes and

sign and date the return.

more time running your business. Use the Electronic

If you have adjustments to liabilities reported for prior

Federal Tax Payment System (EFTPS) to your benefit. For

quarters, see Form 720X, Amended Quarterly Federal

information on EFTPS, visit

or call the

Excise Tax Return. Do not enter adjustments on

EFTPS Customer Service at 1-800-555-4477. If you are

Form 720.

filing Form 720 electronically, you can choose to pay using

electronic funds withdrawal (direct debit). For more

If you attach additional sheets, write your name and EIN

information, see How To Make Deposits on page 8.

on each sheet.

Cat. No. 64240C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18