Form Qpv - Berks Earned Income Tax Bureau

ADVERTISEMENT

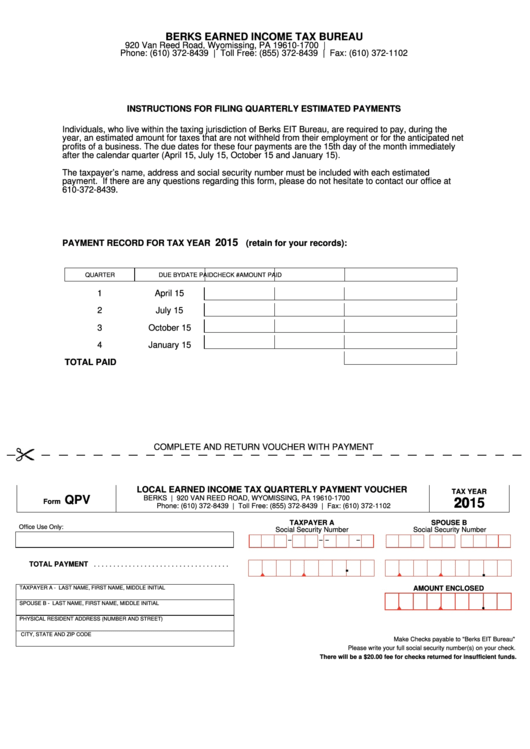

BERKS EARNED INCOME TAX BUREAU

920 Van Reed Road, Wyomissing, PA 19610-1700 |

Phone: (610) 372-8439 | Toll Free: (855) 372-8439 | Fax: (610) 372-1102

INSTRUCTIONS FOR FILING QUARTERLY ESTIMATED PAYMENTS

Individuals, who live within the taxing jurisdiction of Berks EIT Bureau, are required to pay, during the

year, an estimated amount for taxes that are not withheld from their employment or for the anticipated net

profits of a business. The due dates for these four payments are the 15th day of the month immediately

after the calendar quarter (April 15, July 15, October 15 and January 15).

The taxpayer’s name, address and social security number must be included with each estimated

payment. If there are any questions regarding this form, please do not hesitate to contact our office at

610-372-8439.

2015

PAYMENT RECORD FOR TAX YEAR

(retain for your records):

QUARTER

DUE BY

DATE PAID

CHECK #

AMOUNT PAID

1

April 15

2

July 15

3

October 15

4

January 15

TOTAL PAID

COMPLETE AND RETURN VOUCHER WITH PAYMENT

LOCAL EARNED INCOME TAX QUARTERLY PAYMENT VOUCHER

TAX YEAR

QPV

BERKS E.I.T. BUREAU | 920 VAN REED ROAD, WYOMISSING, PA 19610-1700

2015

Form

Phone: (610) 372-8439 | Toll Free: (855) 372-8439 | Fax: (610) 372-1102

TAXPAYER A

SPOUSE B

Office Use Only:

Social Security Number

Social Security Number

-

-

-

-

TOTAL PAYMENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

.

TAXPAYER A - LAST NAME, FIRST NAME, MIDDLE INITIAL

AMOUNT ENCLOSED

.

SPOUSE B - LAST NAME, FIRST NAME, MIDDLE INITIAL

PHYSICAL RESIDENT ADDRESS (NUMBER AND STREET)

CITY, STATE AND ZIP CODE

Make Checks payable to "Berks EIT Bureau"

Please write your full social security number(s) on your check.

There will be a $20.00 fee for checks returned for insufficient funds.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2