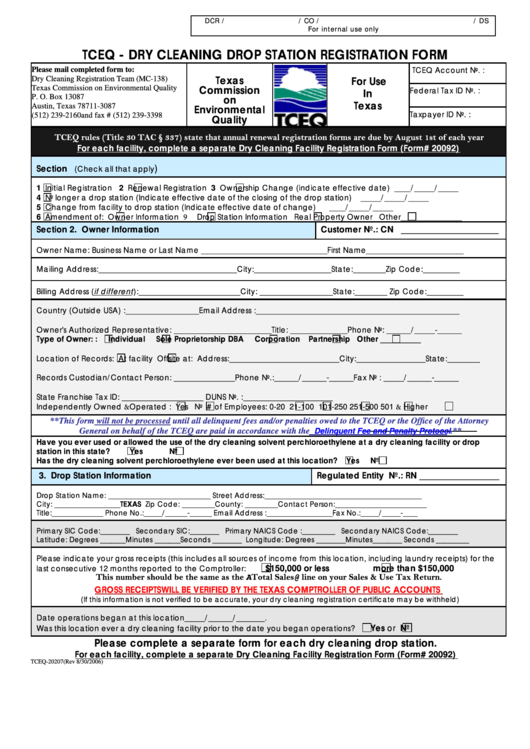

DCR /

/ CO /

/ DS

For internal use only

TCEQ - DRY CLEANING DROP STATION REGISTRATION FORM

TCEQ Account No. :

Please mail completed form to:

Texas

For Use

Dry Cleaning Registration Team (MC-138)

Commission

Texas Commission on Environmental Quality

Federal Tax ID No. :

In

on

P. O. Box 13087

Texas

Environmental

Austin, Texas 78711-3087

Taxpayer ID No. :

Quality

(512) 239-2160 and fax # (512) 239-3398

TCEQ rules (Title 30 TAC § 337) state that annual renewal registration forms are due by August 1st of each year

For each facility, complete a separate Dry Cleaning Facility Registration Form (Form# 20092)

)

Section 1. Reason For Filing the Form

(Check all that apply

1

Initial Registration 2

Renewal Registration 3

Ownership Change (indicate effective date) ____/_____/_____

4

No longer a drop station (Indicate effective date of the closing of the drop station)

_____/_____/_____

5

Change from facility to drop station (Indicate effective date of change)

____/_____/_____

6

Amendment of:

Owner Information 9

Drop Station Information

Real Property Owner

Other_______________

Section 2. Owner Information

Customer No.: CN ______________________

Owner Name: Business Name or Last Name _______________________________First Name________________________

Mailing Address:__________________________________City:___________________State:________Zip Code:_________

Billing Address (if different):_________________________City: __________________State:________ Zip Code:_________

Country (Outside USA) :__________________Email Address :__________________________________________________

Owner's Authorized Representative: ________________________Title: ______________Phone No: ______/_____-______

Type of Owner: :

Individual

Sole Proprietorship DBA

Corporation

Partnership

Other __________

Location of Records:

At facility

Offsite at: Address:___________________________City:_________________State:________

Records Custodian/Contact Person: _______________Phone No.:______/______-______Fax No : _____/______-______

State Franchise Tax ID: ____________________ DUNS No. :______________________

Independently Owned & Operated :

Yes

No # of Employees:

0-20

21-100

101-250

251-500

501 & Higher

**This form will not be processed until all delinquent fees and/or penalties owed to the TCEQ or the Office of the Attorney

General on behalf of the TCEQ are paid in accordance with the

Delinquent Fee and Penalty Protocol

.**

Have you ever used or allowed the use of the dry cleaning solvent perchloroethylene at a dry cleaning facility or drop

station in this state?

Yes

No

Has the dry cleaning solvent perchloroethylene ever been used at this location?

Yes

No

3. Drop Station Information

Regulated Entity No.: RN __________________

Drop Station Name: ____________________________ Street Address:___________________________________________

City: __________________TEXAS Zip Code: _________County: _________Contact Person:_________________________

Title:______________ Phone No.:_____/______-______ Email Address :__________________Fax No.:_____/_____-____

Primary SIC Code:________ Secondary SIC:________ Primary NAICS Code :_________ Secondary NAICS Code:________

Latitude: Degrees _______Minutes _______Seconds ________ Longitude: Degrees ________Minutes________ Seconds _________

Please indicate your gross receipts (this includes all sources of income from this location, including laundry receipts) for the

$150,000 or less

more than $150,000

last consecutive 12 months reported to the Comptroller:

This number should be the same as the ATotal Sales@ line on your Sales & Use Tax Return.

GROSS RECEIPTS WILL BE VERIFIED BY THE TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

(If this information is not verified to be accurate, your dry cleaning registration certificate may be withheld)

Date operations began at this location_____/______/_______.

Yes or

No

Was this location ever a dry cleaning facility prior to the date you began operations?

Please complete a separate form for each dry cleaning drop station.

For each facility, complete a separate Dry Cleaning Facility Registration Form (Form# 20092)

TCEQ-20207(Rev 8/30/2006)

1

1 2

2