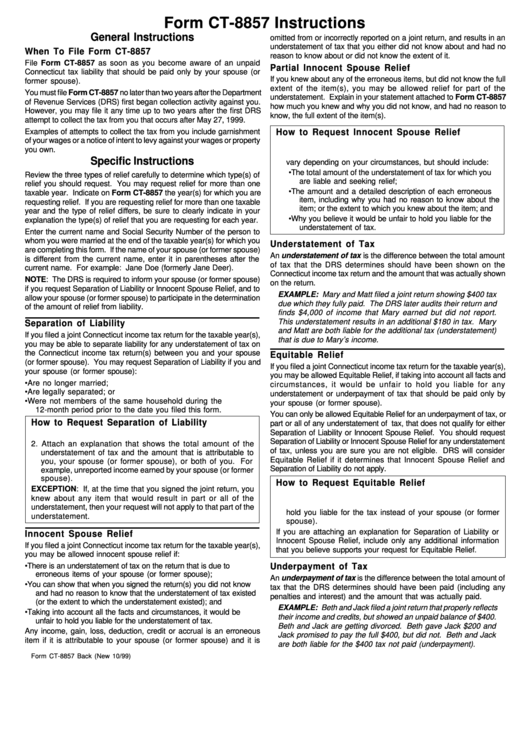

Form Ct-8857 Instructions

ADVERTISEMENT

Form CT-8857 Instructions

General Instructions

omitted from or incorrectly reported on a joint return, and results in an

understatement of tax that you either did not know about and had no

When To File Form CT-8857

reason to know about or did not know the extent of it.

File Form CT-8857 as soon as you become aware of an unpaid

Partial Innocent Spouse Relief

Connecticut tax liability that should be paid only by your spouse (or

If you knew about any of the erroneous items, but did not know the full

former spouse).

extent of the item(s), you may be allowed relief for part of the

You must file Form CT-8857 no later than two years after the Department

understatement. Explain in your statement attached to Form CT-8857

of Revenue Services (DRS) first began collection activity against you.

how much you knew and why you did not know, and had no reason to

However, you may file it any time up to two years after the first DRS

know, the full extent of the item(s).

attempt to collect the tax from you that occurs after May 27, 1999.

Examples of attempts to collect the tax from you include garnishment

How to Request Innocent Spouse Relief

of your wages or a notice of intent to levy against your wages or property

1. Check the box on Line 2.

you own.

2. Attach an explanation of why you qualify. The explanation will

Specific Instructions

vary depending on your circumstances, but should include:

• The total amount of the understatement of tax for which you

Review the three types of relief carefully to determine which type(s) of

are liable and seeking relief;

relief you should request. You may request relief for more than one

• The amount and a detailed description of each erroneous

taxable year. Indicate on Form CT-8857 the year(s) for which you are

item, including why you had no reason to know about the

requesting relief. If you are requesting relief for more than one taxable

item; or the extent to which you knew about the item; and

year and the type of relief differs, be sure to clearly indicate in your

• Why you believe it would be unfair to hold you liable for the

explanation the type(s) of relief that you are requesting for each year.

understatement of tax.

Enter the current name and Social Security Number of the person to

whom you were married at the end of the taxable year(s) for which you

Understatement of Tax

are completing this form. If the name of your spouse (or former spouse)

An understatement of tax is the difference between the total amount

is different from the current name, enter it in parentheses after the

of tax that the DRS determines should have been shown on the

current name. For example: Jane Doe (formerly Jane Deer).

Connecticut income tax return and the amount that was actually shown

NOTE: The DRS is required to inform your spouse (or former spouse)

on the return.

if you request Separation of Liability or Innocent Spouse Relief, and to

EXAMPLE: Mary and Matt filed a joint return showing $400 tax

allow your spouse (or former spouse) to participate in the determination

due which they fully paid. The DRS later audits their return and

of the amount of relief from liability.

finds $4,000 of income that Mary earned but did not report.

This understatement results in an additional $180 in tax. Mary

Separation of Liability

and Matt are both liable for the additional tax (understatement)

If you filed a joint Connecticut income tax return for the taxable year(s),

that is due to Mary’s income.

you may be able to separate liability for any understatement of tax on

the Connecticut income tax return(s) between you and your spouse

Equitable Relief

(or former spouse). You may request Separation of Liability if you and

If you filed a joint Connecticut income tax return for the taxable year(s),

your spouse (or former spouse):

you may be allowed Equitable Relief, if taking into account all facts and

• Are no longer married;

circumstances, it would be unfair to hold you liable for any

• Are legally separated; or

understatement or underpayment of tax that should be paid only by

• Were not members of the same household during the

your spouse (or former spouse).

12-month period prior to the date you filed this form.

You can only be allowed Equitable Relief for an underpayment of tax, or

How to Request Separation of Liability

part or all of any understatement of tax, that does not qualify for either

Separation of Liability or Innocent Spouse Relief. You should request

1. Check the box on Line 1.

Separation of Liability or Innocent Spouse Relief for any understatement

2. Attach an explanation that shows the total amount of the

of tax, unless you are sure you are not eligible. DRS will consider

understatement of tax and the amount that is attributable to

Equitable Relief if it determines that Innocent Spouse Relief and

you, your spouse (or former spouse), or both of you. For

Separation of Liability do not apply.

example, unreported income earned by your spouse (or former

spouse).

How to Request Equitable Relief

EXCEPTION: If, at the time that you signed the joint return, you

1. Check the box on Line 3.

knew about any item that would result in part or all of the

2. Attach an explanation of why you believe that it would be unfair to

understatement, then your request will not apply to that part of the

hold you liable for the tax instead of your spouse (or former

understatement.

spouse).

If you are attaching an explanation for Separation of Liability or

Innocent Spouse Relief

Innocent Spouse Relief, include only any additional information

If you filed a joint Connecticut income tax return for the taxable year(s),

that you believe supports your request for Equitable Relief.

you may be allowed innocent spouse relief if:

• There is an understatement of tax on the return that is due to

Underpayment of Tax

erroneous items of your spouse (or former spouse);

An underpayment of tax is the difference between the total amount of

• You can show that when you signed the return(s) you did not know

tax that the DRS determines should have been paid (including any

and had no reason to know that the understatement of tax existed

penalties and interest) and the amount that was actually paid.

(or the extent to which the understatement existed); and

EXAMPLE: Beth and Jack filed a joint return that properly reflects

• Taking into account all the facts and circumstances, it would be

their income and credits, but showed an unpaid balance of $400.

unfair to hold you liable for the understatement of tax.

Beth and Jack are getting divorced. Beth gave Jack $200 and

Any income, gain, loss, deduction, credit or accrual is an erroneous

Jack promised to pay the full $400, but did not. Beth and Jack

item if it is attributable to your spouse (or former spouse) and it is

are both liable for the $400 tax not paid (underpayment).

Form CT-8857 Back (New 10/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1