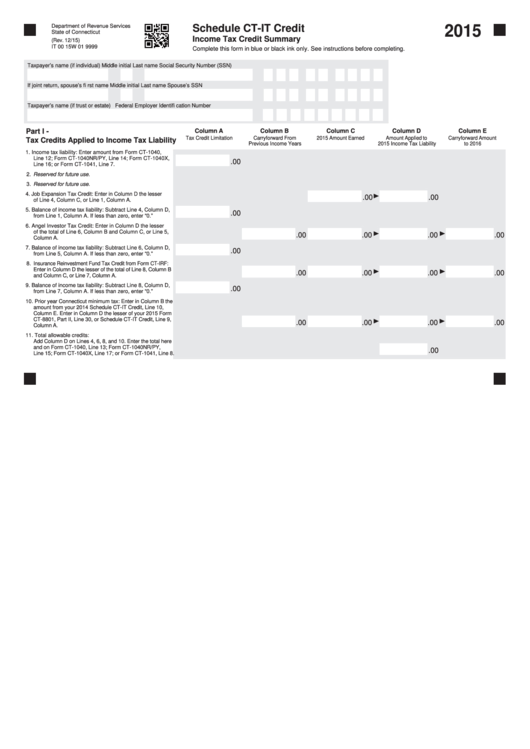

Schedule Ct-It Credit - Income Tax Credit Summary - 2015

ADVERTISEMENT

Department of Revenue Services

Schedule CT-IT Credit

2015

State of Connecticut

Income Tax Credit Summary

(Rev. 12/15)

IT 00 15W 01 9999

Complete this form in blue or black ink only. See instructions before completing.

Taxpayer’s name (if individual)

Middle initial Last name

Social Security Number (SSN)

If joint return, spouse’s fi rst name Middle initial Last name

Spouse’s SSN

Taxpayer’s name (if trust or estate)

Federal Employer Identifi cation Number

Part I -

Column A

Column B

Column C

Column D

Column E

Tax Credit Limitation

Carryforward From

2015 Amount Earned

Amount Applied to

Carryforward Amount

Tax Credits Applied to Income Tax Liability

Previous Income Years

2015 Income Tax Liability

to 2016

1. Income tax liability: Enter amount from Form CT-1040,

Line 12; Form CT-1040NR/PY, Line 14; Form CT-1040X,

.00

Line 16; or Form CT-1041, Line 7.

2. Reserved for future use.

3. Reserved for future use.

4. Job Expansion Tax Credit: Enter in Column D the lesser

.00

.00

of Line 4, Column C, or Line 1, Column A.

5. Balance of income tax liability: Subtract Line 4, Column D,

.00

from Line 1, Column A. If less than zero, enter “0.”

6. Angel Investor Tax Credit: Enter in Column D the lesser

of the total of Line 6, Column B and Column C, or Line 5,

.00

.00

.00

.00

Column A.

7. Balance of income tax liability: Subtract Line 6, Column D,

.00

from Line 5, Column A. If less than zero, enter “0.”

8. Insurance Reinvestment Fund Tax Credit from Form CT-IRF:

Enter in Column D the lesser of the total of Line 8, Column B

.00

.00

.00

.00

and Column C, or Line 7, Column A.

9. Balance of income tax liability: Subtract Line 8, Column D,

.00

from Line 7, Column A. If less than zero, enter “0.”

10. Prior year Connecticut minimum tax: Enter in Column B the

amount from your 2014 Schedule CT-IT Credit, Line 10,

Column E. Enter in Column D the lesser of your 2015 Form

CT-8801, Part II, Line 30, or Schedule CT-IT Credit, Line 9,

.00

.00

.00

.00

Column A.

11. Total allowable credits:

Add Column D on Lines 4, 6, 8, and 10. Enter the total here

and on Form CT-1040, Line 13; Form CT-1040NR/PY,

.00

Line 15; Form CT-1040X, Line 17; or Form CT-1041, Line 8.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4