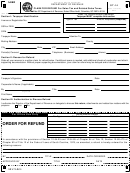

Form St-6 - Claim For Verified Overpayment Information And Instructions

ADVERTISEMENT

ST-6 Claim for Verified Overpayment

Information and Instructions

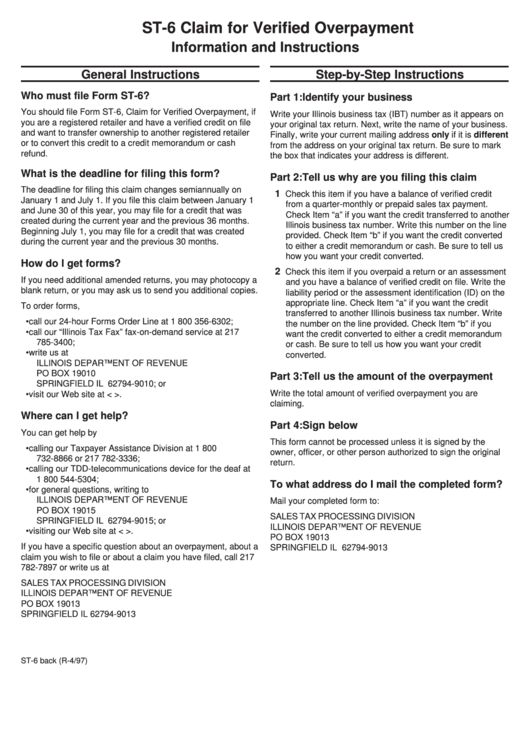

General Instructions

Step-by-Step Instructions

Who must file Form ST-6?

Part 1: Identify your business

You should file Form ST-6, Claim for Verified Overpayment, if

Write your Illinois business tax (IBT) number as it appears on

you are a registered retailer and have a verified credit on file

your original tax return. Next, write the name of your business.

and want to transfer ownership to another registered retailer

Finally, write your current mailing address only if it is different

or to convert this credit to a credit memorandum or cash

from the address on your original tax return. Be sure to mark

refund.

the box that indicates your address is different.

What is the deadline for filing this form?

Part 2: Tell us why are you filing this claim

The deadline for filing this claim changes semiannually on

1

Check this item if you have a balance of verified credit

January 1 and July 1. If you file this claim between January 1

from a quarter-monthly or prepaid sales tax payment.

and June 30 of this year, you may file for a credit that was

Check Item “a” if you want the credit transferred to another

created during the current year and the previous 36 months.

Illinois business tax number. Write this number on the line

Beginning July 1, you may file for a credit that was created

provided. Check Item “b” if you want the credit converted

during the current year and the previous 30 months.

to either a credit memorandum or cash. Be sure to tell us

how you want your credit converted.

How do I get forms?

2

Check this item if you overpaid a return or an assessment

If you need additional amended returns, you may photocopy a

and you have a balance of verified credit on file. Write the

blank return, or you may ask us to send you additional copies.

liability period or the assessment identification (ID) on the

appropriate line. Check Item “a” if you want the credit

To order forms,

transferred to another Illinois business tax number. Write

• call our 24-hour Forms Order Line at 1 800 356-6302;

the number on the line provided. Check Item “b” if you

• call our “Illinois Tax Fax” fax-on-demand service at 217

want the credit converted to either a credit memorandum

785-3400;

or cash. Be sure to tell us how you want your credit

• write us at

converted.

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19010

Part 3: Tell us the amount of the overpayment

SPRINGFIELD IL 62794-9010; or

Write the total amount of verified overpayment you are

• visit our Web site at <

claiming.

Where can I get help?

Part 4: Sign below

You can get help by

This form cannot be processed unless it is signed by the

• calling our Taxpayer Assistance Division at 1 800

owner, officer, or other person authorized to sign the original

732-8866 or 217 782-3336;

return.

• calling our TDD-telecommunications device for the deaf at

1 800 544-5304;

To what address do I mail the completed form?

• for general questions, writing to

ILLINOIS DEPARTMENT OF REVENUE

Mail your completed form to:

PO BOX 19015

SALES TAX PROCESSING DIVISION

SPRINGFIELD IL 62794-9015; or

ILLINOIS DEPARTMENT OF REVENUE

• visiting our Web site at <

PO BOX 19013

If you have a specific question about an overpayment, about a

SPRINGFIELD IL 62794-9013

claim you wish to file or about a claim you have filed, call 217

782-7897 or write us at

SALES TAX PROCESSING DIVISION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19013

SPRINGFIELD IL 62794-9013

ST-6 back (R-4/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1