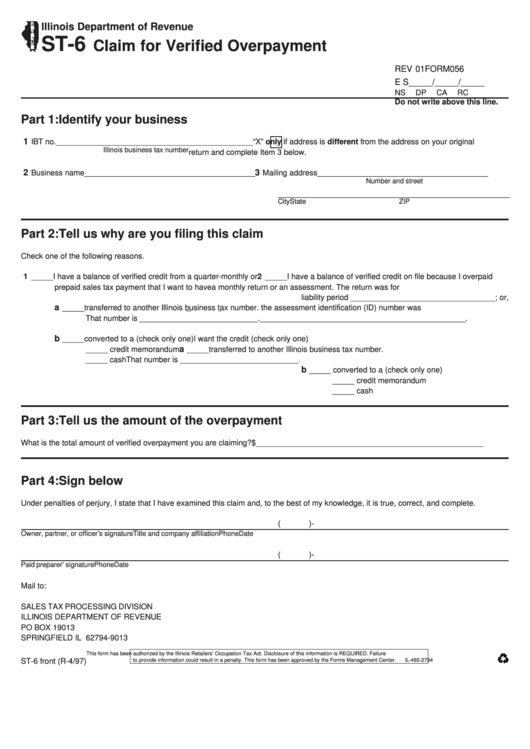

Illinois Department of Revenue

ST-6

Claim for Verified Overpayment

REV 01

FORM 056

E S _____/_____/_____

NS

DP

CA

RC

Do not write above this line.

Part 1: Identify your business

1

IBT no. _____________________________________________

“X” only if address is different from the address on your original

Illinois business tax number

return and complete Item 3 below.

2

3

Business name _______________________________________

Mailing address _______________________________________

Number and street

_____________________________________________________

City

State

ZIP

Part 2: Tell us why are you filing this claim

Check one of the following reasons.

1 _____ I have a balance of verified credit from a quarter-monthly or

2 _____ I have a balance of verified credit on file because I overpaid

prepaid sales tax payment that I want to have

a monthly return or an assessment. The return was for

liability period _________________________________; or,

a

_____ transferred to another Illinois business tax number.

the assessment identification (ID) number was

That number is ___________________________.

_______________________________________________.

b

_____ converted to a (check only one)

I want the credit (check only one)

a

_____ credit memorandum

_____ transferred to another Illinois business tax number.

_____ cash

That number is ___________________________.

b

_____ converted to a (check only one)

_____ credit memorandum

_____ cash

Part 3: Tell us the amount of the overpayment

What is the total amount of verified overpayment you are claiming?

$____________________________________________________

Part 4: Sign below

Under penalties of perjury, I state that I have examined this claim and, to the best of my knowledge, it is true, correct, and complete.

(

)

-

Owner, partner, or officer’s signature

Title and company affiliation

Phone

Date

(

)

-

Paid preparer’ signature

Phone

Date

Mail to:

SALES TAX PROCESSING DIVISION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19013

SPRINGFIELD IL 62794-9013

This form has been authorized by the Illinois Retailers’ Occupation Tax Act. Disclosure of this information is REQUIRED. Failure

to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2734

ST-6 front (R-4/97)

1

1