Instructions For Form G-7430 - Refund For Tax Paid On Unsold Pulltab And Tipboard Tickets - Minnesota Department Of Revenue

ADVERTISEMENT

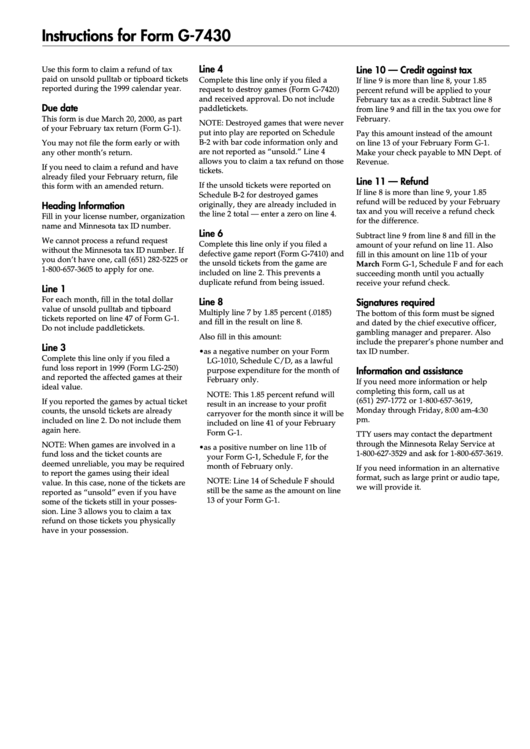

Instructions for Form G-7430

Line 4

Line 10 — Credit against tax

Use this form to claim a refund of tax

paid on unsold pulltab or tipboard tickets

Complete this line only if you filed a

If line 9 is more than line 8, your 1.85

reported during the 1999 calendar year.

request to destroy games (Form G-7420)

percent refund will be applied to your

and received approval. Do not include

February tax as a credit. Subtract line 8

Due date

paddletickets.

from line 9 and fill in the tax you owe for

This form is due March 20, 2000, as part

February.

NOTE: Destroyed games that were never

of your February tax return (Form G-1).

put into play are reported on Schedule

Pay this amount instead of the amount

B-2 with bar code information only and

You may not file the form early or with

on line 13 of your February Form G-1.

are not reported as “unsold.” Line 4

any other month’s return.

Make your check payable to MN Dept. of

allows you to claim a tax refund on those

Revenue.

If you need to claim a refund and have

tickets.

already filed your February return, file

Line 11 — Refund

If the unsold tickets were reported on

this form with an amended return.

If line 8 is more than line 9, your 1.85

Schedule B-2 for destroyed games

refund will be reduced by your February

Heading Information

originally, they are already included in

tax and you will receive a refund check

the line 2 total — enter a zero on line 4.

Fill in your license number, organization

for the difference.

name and Minnesota tax ID number.

Line 6

Subtract line 9 from line 8 and fill in the

We cannot process a refund request

Complete this line only if you filed a

amount of your refund on line 11. Also

without the Minnesota tax ID number. If

defective game report (Form G-7410) and

fill in this amount on line 11b of your

you don’t have one, call (651) 282-5225 or

the unsold tickets from the game are

March Form G-1, Schedule F and for each

1-800-657-3605 to apply for one.

included on line 2. This prevents a

succeeding month until you actually

duplicate refund from being issued.

receive your refund check.

Line 1

For each month, fill in the total dollar

Line 8

Signatures required

value of unsold pulltab and tipboard

Multiply line 7 by 1.85 percent (.0185)

The bottom of this form must be signed

tickets reported on line 47 of Form G-1.

and fill in the result on line 8.

and dated by the chief executive officer,

Do not include paddletickets.

gambling manager and preparer. Also

Also fill in this amount:

include the preparer’s phone number and

Line 3

• as a negative number on your Form

tax ID number.

Complete this line only if you filed a

LG-1010, Schedule C/D, as a lawful

fund loss report in 1999 (Form LG-250)

Information and assistance

purpose expenditure for the month of

and reported the affected games at their

February only.

If you need more information or help

ideal value.

completing this form, call us at

NOTE: This 1.85 percent refund will

(651) 297-1772 or 1-800-657-3619,

If you reported the games by actual ticket

result in an increase to your profit

Monday through Friday, 8:00 am-4:30

counts, the unsold tickets are already

carryover for the month since it will be

pm.

included on line 2. Do not include them

included on line 41 of your February

again here.

Form G-1.

TTY users may contact the department

through the Minnesota Relay Service at

NOTE: When games are involved in a

• as a positive number on line 11b of

1-800-627-3529 and ask for 1-800-657-3619.

fund loss and the ticket counts are

your Form G-1, Schedule F, for the

deemed unreliable, you may be required

month of February only.

If you need information in an alternative

to report the games using their ideal

format, such as large print or audio tape,

NOTE: Line 14 of Schedule F should

value. In this case, none of the tickets are

we will provide it.

still be the same as the amount on line

reported as “unsold” even if you have

13 of your Form G-1.

some of the tickets still in your posses-

sion. Line 3 allows you to claim a tax

refund on those tickets you physically

have in your possession.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1