Eta Form 9062 - Work Opportunity Tax Credit - 2007 Page 3

ADVERTISEMENT

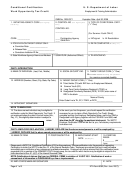

PART II.

EMPLOYER DECLARATION:

Box 16:

Name of Firm. Enter full name of the employing firm (the firm where the employee will actually work).

Box 17:

Position/Job Title. Enter the position or job title the employee will hold.

Box 18:

Employment-Start Date. Enter the date the employee began or will begin work for the employing firm.

Box 19:

Starting Wage. Enter the wage or salary which the employee will be paid. If not known, enter an estimated wage.

Box 20:

Employer’s Name and Signature. Enter employer’s corresponding signature here.

Box 21. Date. Enter month, day and year when you signed this form.

Persons are not required to respond to this collection of information unless it displays a currently valid OMB Control Number.

Respondents’ obligation to reply to these requirements for obtaining the tax credit per P.L. 104-188. Public reporting burden for this

collection of information is estimated to average .33 minutes per response, including the time for reading instruction, searching

existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send

comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing the

burden to the U.S. Department of Labor, Division of Adult Services, Room C-4514, Washington, D.C. 20210 (Paperwork Reduction

Project 1205-0371)

Page 3 of 3

ETA Form 9062 (Rev. June 2007)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3