Schedule Mw-3nr Instructions For 2000

ADVERTISEMENT

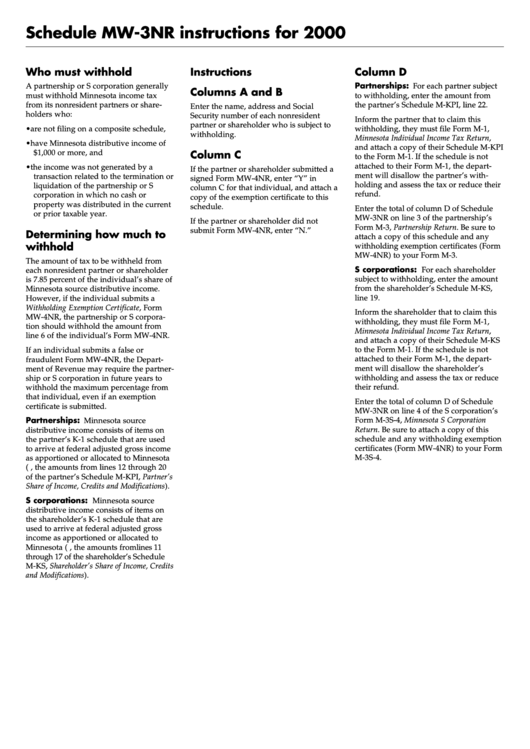

Schedule MW-3NR instructions for 2000

Who must withhold

Instructions

Column D

Partnerships: For each partner subject

A partnership or S corporation generally

Columns A and B

must withhold Minnesota income tax

to withholding, enter the amount from

from its nonresident partners or share-

the partner’s Schedule M-KPI, line 22.

Enter the name, address and Social

holders who:

Security number of each nonresident

Inform the partner that to claim this

partner or shareholder who is subject to

• are not filing on a composite schedule,

withholding, they must file Form M-1,

withholding.

Minnesota Individual Income Tax Return,

• have Minnesota distributive income of

and attach a copy of their Schedule M-KPI

$1,000 or more, and

Column C

to the Form M-1. If the schedule is not

attached to their Form M-1, the depart-

• the income was not generated by a

If the partner or shareholder submitted a

ment will disallow the partner’s with-

transaction related to the termination or

signed Form MW-4NR, enter “Y” in

holding and assess the tax or reduce their

liquidation of the partnership or S

column C for that individual, and attach a

refund.

corporation in which no cash or

copy of the exemption certificate to this

property was distributed in the current

schedule.

Enter the total of column D of Schedule

or prior taxable year.

MW-3NR on line 3 of the partnership’s

If the partner or shareholder did not

Form M-3, Partnership Return. Be sure to

submit Form MW-4NR, enter “N.”

Determining how much to

attach a copy of this schedule and any

withhold

withholding exemption certificates (Form

MW-4NR) to your Form M-3.

The amount of tax to be withheld from

S corporations: For each shareholder

each nonresident partner or shareholder

subject to withholding, enter the amount

is 7.85 percent of the individual’s share of

from the shareholder’s Schedule M-KS,

Minnesota source distributive income.

line 19.

However, if the individual submits a

Withholding Exemption Certificate, Form

Inform the shareholder that to claim this

MW-4NR, the partnership or S corpora-

withholding, they must file Form M-1,

tion should withhold the amount from

Minnesota Individual Income Tax Return,

line 6 of the individual’s Form MW-4NR.

and attach a copy of their Schedule M-KS

to the Form M-1. If the schedule is not

If an individual submits a false or

attached to their Form M-1, the depart-

fraudulent Form MW-4NR, the Depart-

ment will disallow the shareholder’s

ment of Revenue may require the partner-

withholding and assess the tax or reduce

ship or S corporation in future years to

their refund.

withhold the maximum percentage from

that individual, even if an exemption

Enter the total of column D of Schedule

certificate is submitted.

MW-3NR on line 4 of the S corporation’s

Partnerships: Minnesota source

Form M-3S-4, Minnesota S Corporation

Return. Be sure to attach a copy of this

distributive income consists of items on

schedule and any withholding exemption

the partner’s K-1 schedule that are used

certificates (Form MW-4NR) to your Form

to arrive at federal adjusted gross income

M-3S-4.

as apportioned or allocated to Minnesota

(i.e., the amounts from lines 12 through 20

of the partner’s Schedule M-KPI, Partner’s

Share of Income, Credits and Modifications).

S corporations: Minnesota source

distributive income consists of items on

the shareholder’s K-1 schedule that are

used to arrive at federal adjusted gross

income as apportioned or allocated to

Minnesota (i.e., the amounts from lines 11

through 17 of the shareholder’s Schedule

M-KS, Shareholder’s Share of Income, Credits

and Modifications).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1