Schedule M-1nr Instructions For 2000

ADVERTISEMENT

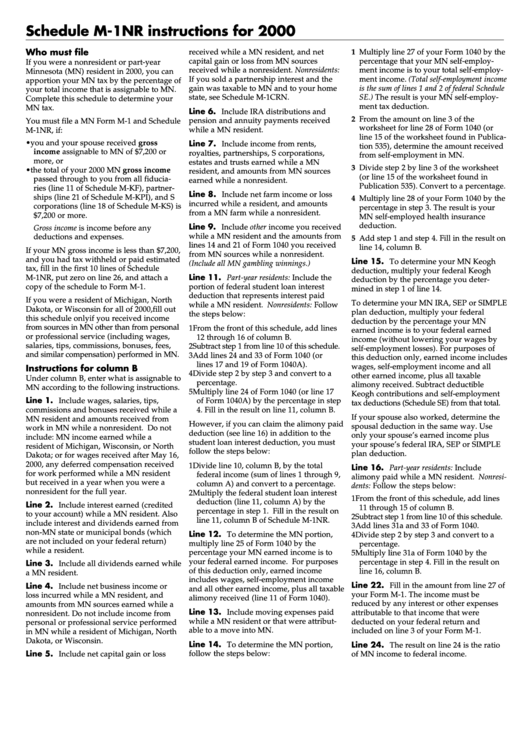

Schedule M-1NR instructions for 2000

Who must file

received while a MN resident, and net

1 Multiply line 27 of your Form 1040 by the

capital gain or loss from MN sources

percentage that your MN self-employ-

If you were a nonresident or part-year

received while a nonresident. Nonresidents:

ment income is to your total self-employ-

Minnesota (MN) resident in 2000, you can

If you sold a partnership interest and the

ment income. (Total self-employment income

apportion your MN tax by the percentage of

gain was taxable to MN and to your home

is the sum of lines 1 and 2 of federal Schedule

your total income that is assignable to MN.

state, see Schedule M-1CRN.

SE.) The result is your MN self-employ-

Complete this schedule to determine your

ment tax deduction.

MN tax.

Line 6. Include IRA distributions and

2 From the amount on line 3 of the

pension and annuity payments received

You must file a MN Form M-1 and Schedule

worksheet for line 28 of Form 1040 (or

M-1NR, if:

while a MN resident.

line 15 of the worksheet found in Publica-

• you and your spouse received gross

Line 7. Include income from rents,

tion 535), determine the amount received

income assignable to MN of $7,200 or

royalties, partnerships, S corporations,

from self-employment in MN.

more, or

estates and trusts earned while a MN

3 Divide step 2 by line 3 of the worksheet

• the total of your 2000 MN gross income

resident, and amounts from MN sources

(or line 15 of the worksheet found in

passed through to you from all fiducia-

earned while a nonresident.

Publication 535). Convert to a percentage.

ries (line 11 of Schedule M-KF), partner-

Line 8. Include net farm income or loss

ships (line 21 of Schedule M-KPI), and S

4 Multiply line 28 of your Form 1040 by the

incurred while a resident, and amounts

corporations (line 18 of Schedule M-KS) is

percentage in step 3. The result is your

from a MN farm while a nonresident.

$7,200 or more.

MN self-employed health insurance

deduction.

Line 9. Include other income you received

Gross income is income before any

while a MN resident and the amounts from

deductions and expenses.

5 Add step 1 and step 4. Fill in the result on

lines 14 and 21 of Form 1040 you received

line 14, column B.

If your MN gross income is less than $7,200,

from MN sources while a nonresident.

and you had tax withheld or paid estimated

Line 15. To determine your MN Keogh

(Include all MN gambling winnings.)

tax, fill in the first 10 lines of Schedule

deduction, multiply your federal Keogh

Line 11. Part-year residents: Include the

M-1NR, put zero on line 26, and attach a

deduction by the percentage you deter-

copy of the schedule to Form M-1.

portion of federal student loan interest

mined in step 1 of line 14.

deduction that represents interest paid

If you were a resident of Michigan, North

To determine your MN IRA, SEP or SIMPLE

while a MN resident. Nonresidents: Follow

Dakota, or Wisconsin for all of 2000, fill out

plan deduction, multiply your federal

the steps below:

this schedule only if you received income

deduction by the percentage your MN

from sources in MN other than from personal

1 From the front of this schedule, add lines

earned income is to your federal earned

or professional service (including wages,

12 through 16 of column B.

income (without lowering your wages by

salaries, tips, commissions, bonuses, fees,

2 Subtract step 1 from line 10 of this schedule.

self-employment losses). For purposes of

and similar compensation) performed in MN.

3 Add lines 24 and 33 of Form 1040 (or

this deduction only, earned income includes

lines 17 and 19 of Form 1040A).

wages, self-employment income and all

Instructions for column B

4 Divide step 2 by step 3 and convert to a

other earned income, plus all taxable

Under column B, enter what is assignable to

percentage.

alimony received. Subtract deductible

MN according to the following instructions.

5 Multiply line 24 of Form 1040 (or line 17

Keogh contributions and self-employment

Line 1. Include wages, salaries, tips,

of Form 1040A) by the percentage in step

tax deductions (Schedule SE) from that total.

commissions and bonuses received while a

4. Fill in the result on line 11, column B.

If your spouse also worked, determine the

MN resident and amounts received from

However, if you can claim the alimony paid

spousal deduction in the same way. Use

work in MN while a nonresident. Do not

deduction (see line 16) in addition to the

only your spouse’s earned income plus

include: MN income earned while a

student loan interest deduction, you must

your spouse’s federal IRA, SEP or SIMPLE

resident of Michigan, Wisconsin, or North

follow the steps below:

plan deduction.

Dakota; or for wages received after May 16,

2000, any deferred compensation received

1 Divide line 10, column B, by the total

Line 16. Part-year residents: Include

for work performed while a MN resident

federal income (sum of lines 1 through 9,

alimony paid while a MN resident. Nonresi-

but received in a year when you were a

column A) and convert to a percentage.

dents: Follow the steps below:

nonresident for the full year.

2 Multiply the federal student loan interest

1 From the front of this schedule, add lines

deduction (line 11, column A) by the

Line 2. Include interest earned (credited

11 through 15 of column B.

percentage in step 1. Fill in the result on

to your account) while a MN resident. Also

2 Subtract step 1 from line 10 of this schedule.

line 11, column B of Schedule M-1NR.

include interest and dividends earned from

3 Add lines 31a and 33 of Form 1040.

non-MN state or municipal bonds (which

Line 12. To determine the MN portion,

4 Divide step 2 by step 3 and convert to a

are not included on your federal return)

multiply line 25 of Form 1040 by the

percentage.

while a resident.

percentage your MN earned income is to

5 Multiply line 31a of Form 1040 by the

your federal earned income. For purposes

percentage in step 4. Fill in the result on

Line 3. Include all dividends earned while

of this deduction only, earned income

line 16, column B.

a MN resident.

includes wages, self-employment income

Line 22. Fill in the amount from line 27 of

Line 4. Include net business income or

and all other earned income, plus all taxable

your Form M-1. The income must be

loss incurred while a MN resident, and

alimony received (line 11 of Form 1040).

reduced by any interest or other expenses

amounts from MN sources earned while a

Line 13. Include moving expenses paid

attributable to that income that were

nonresident. Do not include income from

while a MN resident or that were attribut-

deducted on your federal return and

personal or professional service performed

able to a move into MN.

included on line 3 of your Form M-1.

in MN while a resident of Michigan, North

Dakota, or Wisconsin.

Line 14. To determine the MN portion,

Line 24. The result on line 24 is the ratio

Line 5. Include net capital gain or loss

follow the steps below:

of MN income to federal income.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1