Schedule M-1m Instructions For 2000

ADVERTISEMENT

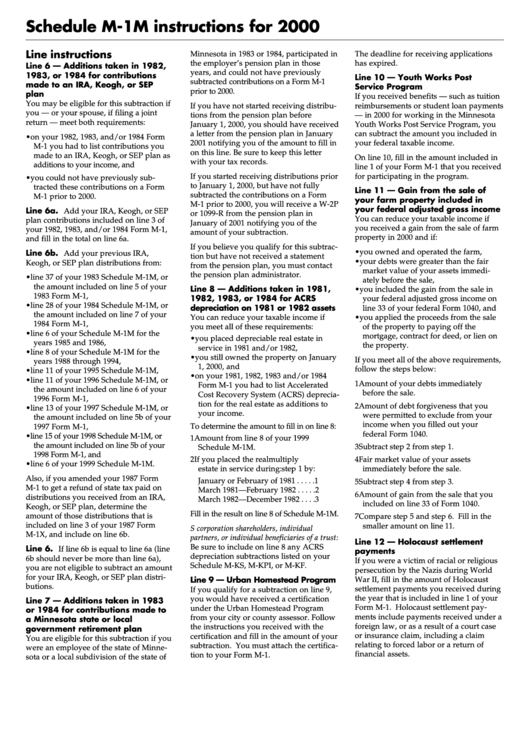

Schedule M-1M instructions for 2000

Line instructions

Minnesota in 1983 or 1984, participated in

The deadline for receiving applications

the employer’s pension plan in those

has expired.

Line 6 — Additions taken in 1982,

years, and could not have previously

1983, or 1984 for contributions

Line 10 — Youth Works Post

subtracted contributions on a Form M-1

made to an IRA, Keogh, or SEP

Service Program

prior to 2000.

plan

If you received benefits — such as tuition

You may be eligible for this subtraction if

If you have not started receiving distribu-

reimbursements or student loan payments

you — or your spouse, if filing a joint

tions from the pension plan before

— in 2000 for working in the Minnesota

return — meet both requirements:

January 1, 2000, you should have received

Youth Works Post Service Program, you

a letter from the pension plan in January

can subtract the amount you included in

• on your 1982, 1983, and/or 1984 Form

2001 notifying you of the amount to fill in

your federal taxable income.

M-1 you had to list contributions you

on this line. Be sure to keep this letter

made to an IRA, Keogh, or SEP plan as

On line 10, fill in the amount included in

with your tax records.

additions to your income, and

line 1 of your Form M-1 that you received

If you started receiving distributions prior

for participating in the program.

• you could not have previously sub-

to January 1, 2000, but have not fully

tracted these contributions on a Form

Line 11 — Gain from the sale of

subtracted the contributions on a Form

M-1 prior to 2000.

your farm property included in

M-1 prior to 2000, you will receive a W-2P

your federal adjusted gross income

Line 6a. Add your IRA, Keogh, or SEP

or 1099-R from the pension plan in

You can reduce your taxable income if

plan contributions included on line 3 of

January of 2001 notifying you of the

you received a gain from the sale of farm

your 1982, 1983, and/or 1984 Form M-1,

amount of your subtraction.

property in 2000 and if:

and fill in the total on line 6a.

If you believe you qualify for this subtrac-

• you owned and operated the farm,

Line 6b. Add your previous IRA,

tion but have not received a statement

• your debts were greater than the fair

Keogh, or SEP plan distributions from:

from the pension plan, you must contact

market value of your assets immedi-

the pension plan administrator.

• line 37 of your 1983 Schedule M-1M, or

ately before the sale,

the amount included on line 5 of your

Line 8 — Additions taken in 1981,

• you included the gain from the sale in

1983 Form M-1,

1982, 1983, or 1984 for ACRS

your federal adjusted gross income on

• line 28 of your 1984 Schedule M-1M, or

depreciation on 1981 or 1982 assets

line 33 of your federal Form 1040, and

the amount included on line 7 of your

You can reduce your taxable income if

• you applied the proceeds from the sale

1984 Form M-1,

you meet all of these requirements:

of the property to paying off the

• line 6 of your Schedule M-1M for the

mortgage, contract for deed, or lien on

• you placed depreciable real estate in

years 1985 and 1986,

the property.

service in 1981 and/or 1982,

• line 8 of your Schedule M-1M for the

• you still owned the property on January

If you meet all of the above requirements,

years 1988 through 1994,

1, 2000, and

follow the steps below:

• line 11 of your 1995 Schedule M-1M,

• on your 1981, 1982, 1983 and/or 1984

• line 11 of your 1996 Schedule M-1M, or

1 Amount of your debts immediately

Form M-1 you had to list Accelerated

the amount included on line 6 of your

before the sale.

Cost Recovery System (ACRS) deprecia-

1996 Form M-1,

tion for the real estate as additions to

2 Amount of debt forgiveness that you

• line 13 of your 1997 Schedule M-1M, or

your income.

were permitted to exclude from your

the amount included on line 5b of your

income when you filled out your

To determine the amount to fill in on line 8:

1997 Form M-1,

federal Form 1040.

• line 15 of your 1998 Schedule M-1M, or

1 Amount from line 8 of your 1999

the amount included on line 5b of your

3 Subtract step 2 from step 1.

Schedule M-1M.

1998 Form M-1, and

2 If you placed the real

multiply

4 Fair market value of your assets

• line 6 of your 1999 Schedule M-1M.

estate in service during:

step 1 by:

immediately before the sale.

Also, if you amended your 1987 Form

January or February of 1981 . . . . . 1

5 Subtract step 4 from step 3.

M-1 to get a refund of state tax paid on

March 1981—February 1982 . . . . . 2

6 Amount of gain from the sale that you

distributions you received from an IRA,

March 1982—December 1982 . . . . 3

included on line 33 of Form 1040.

Keogh, or SEP plan, determine the

Fill in the result on line 8 of Schedule M-1M.

amount of those distributions that is

7 Compare step 5 and step 6. Fill in the

included on line 3 of your 1987 Form

smaller amount on line 11.

S corporation shareholders, individual

M-1X, and include on line 6b.

partners, or individual beneficiaries of a trust:

Line 12 — Holocaust settlement

Be sure to include on line 8 any ACRS

Line 6. If line 6b is equal to line 6a (line

payments

depreciation subtractions listed on your

6b should never be more than line 6a),

If you were a victim of racial or religious

Schedule M-KS, M-KPI, or M-KF.

you are not eligible to subtract an amount

persecution by the Nazis during World

for your IRA, Keogh, or SEP plan distri-

Line 9 — Urban Homestead Program

War II, fill in the amount of Holocaust

butions.

settlement payments you received during

If you qualify for a subtraction on line 9,

the year that is included in line 1 of your

you would have received a certification

Line 7 — Additions taken in 1983

Form M-1. Holocaust settlement pay-

under the Urban Homestead Program

or 1984 for contributions made to

ments include payments received under a

from your city or county assessor. Follow

a Minnesota state or local

foreign law, or as a result of a court case

the instructions you received with the

government retirement plan

or insurance claim, including a claim

certification and fill in the amount of your

You are eligible for this subtraction if you

relating to forced labor or a return of

subtraction. You must attach the certifica-

were an employee of the state of Minne-

financial assets.

tion to your Form M-1.

sota or a local subdivision of the state of

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1