TC-557_i

Utah PACT Act Monthly Report Instructions

General Information

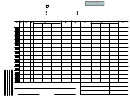

Instructions

The Prevent All Cigarette Trafficking (PACT) Act requires all

Enter the following information for each tobacco type you sold in

delivery shippers, including direct, Internet and other mail-order

Utah during the month:

sellers to:

Section 1. Reporting Entity

• Register with Utah and report by the 10th of each month all

• Complete all entries.

shipments into Utah for the prior month. This is reported on

form TC-557.

Section 2. Reporting Period

• Pay tobacco taxes and affix required tax stamps before

• Enter the tax period you are reporting (for example, June,

delivering cigarettes or other tobacco products.

2011).

Section 3. Sales into Utah

Definitions

• Invoice date

Cigarette

• Invoice number

Any roll for smoking containing tobacco that is wrapped in paper or

• Name of purchasing entity

another material (except tobacco) regardless of size or shape. This

includes tobacco that is flavored, adulterated or mixed with any

• Address of purchasing entity

other ingredient.

• FEIN of purchasing entity

Little Cigars

• Utah Tobacco license number of the purchasing entity

Any roll for smoking containing tobacco that uses a cellulose

• Choose Product Type.

acetate (or similar) filter and is wrapped in a substance partially

• Enter brand purchaser bought.

containing tobacco.

• Enter quantity sold for each individually: packs, sticks, units

Moist Snuff

and ounces.

Tobacco that is:

• finely cut, ground or powdered

• has at least 45 percent moisture content, and

If you have questions, contact the Tax Commission at

801-297-2200 or 1-800-662-4335, ext. 2200.

• not meant to be smoked or placed in the nasal cavity.

Or visit our website: tax.utah.gov.

Moist snuff includes single-use pouches of loose tobacco if the

__________________ _ _

product has at least 45 percent moisture content (such as Skoal

Bandits, Timberwolf packs and Copenhagen pouches).

If you need an accommodation under the Americans with Disabili-

ties Act, contact the Tax Commission at 801-297-3811 or TDD

Report all tobacco products bought during the reporting period.

801-297-2020. Please allow three working days for a response.

Tobacco Products

Tobacco products include:

• Cigars (including little cigars)

• Cigarette tobacco (roll-your-own)

• Chewing tobacco

• Pipe tobacco

• Other tobacco products prepared for chewing or smoking

Tobacco products do not include cigarettes.

1

1 2

2 3

3