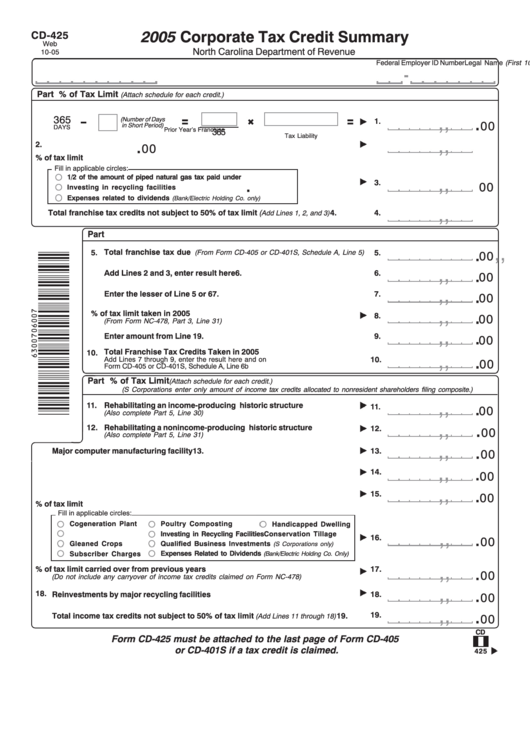

Form Cd-425 - Corporate Tax Credit Summary - 2005

ADVERTISEMENT

2005 Corporate Tax Credit Summary

CD-425

Web

North Carolina Department of Revenue

10-05

Legal Name (First 10 Characters)

Federal Employer ID Number

Part 1. Franchise Tax Credits Not Subject to 50% of Tax Limit

(Attach schedule for each credit.)

1. Short period credit for change in income year

,

,

.

365

(Number of Days

1.

00

in Short Period)

DAYS

Prior Year’s Franchise

365

Tax Liability

,

,

.

2. Major computer manufacturing facility

2.

00

3. Other franchise tax credits not subject to 50% of tax limit

Fill in applicable circles:

,

,

.

1/2 of the amount of piped natural gas tax paid under G.S. 105-187.43

3.

00

Investing in recycling facilities

Expenses related to dividends

(Bank/Electric Holding Co. only)

,

,

.

4.

Total franchise tax credits not subject to 50% of tax limit (

4.

Add Lines 1, 2, and 3)

00

Part 2. Computation of Franchise Tax Credits Taken in 2005

,

,

.

Total franchise tax due

5.

5.

(From Form CD-405 or CD-401S, Schedule A, Line 5)

00

,

,

.

6.

Add Lines 2 and 3, enter result here

6.

00

,

,

.

7.

Enter the lesser of Line 5 or 6

7.

00

,

,

.

8. Total franchise tax credits subject to 50% of tax limit taken in 2005

8.

00

(From Form NC-478, Part 3, Line 31)

,

,

.

9.

Enter amount from Line 1

9.

00

Total Franchise Tax Credits Taken in 2005

10.

,

,

.

10.

Add Lines 7 through 9, enter the result here and on

00

Form CD-405 or CD-401S, Schedule A, Line 6b

Part 3. Income Tax Credits Not Subject to 50% of Tax Limit

(Attach schedule for each credit.)

(S Corporations enter only amount of income tax credits allocated to nonresident shareholders filing composite.)

,

,

.

11.

Rehabilitating an income-producing historic structure

11.

00

(Also complete Part 5, Line 30)

,

,

.

12.

Rehabilitating a nonincome-producing historic structure

12.

00

(Also complete Part 5, Line 31)

,

,

.

13.

Major computer manufacturing facility

13.

00

,

,

.

14. Certain real property donations

14.

00

,

,

.

15. Savings and loan supervisory fees

15.

00

16. Other income tax credits not subject to 50% of tax limit

Fill in applicable circles:

Cogeneration Plant

Poultry Composting

Handicapped Dwelling

,

,

.

Conservation Tillage

Investing in Recycling Facilities

16.

00

Gleaned Crops

Qualified Business Investments

(S Corporations only)

Expenses Related to Dividends

Subscriber Charges

(Bank/Electric Holding Co. Only)

,

,

.

17. Income tax credits not subject to 50% of tax limit carried over from previous years

17.

00

(Do not include any carryover of income tax credits claimed on Form NC-478)

,

,

.

18.

Reinvestments by major recycling facilities

18.

00

,

,

.

19.

19.

Total income tax credits not subject to 50% of tax limit

(Add Lines 11 through 18)

00

CD

Form CD-425 must be attached to the last page of Form CD-405

or CD-401S if a tax credit is claimed.

425

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2