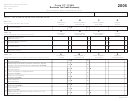

Form Cd-425 - Corporate Tax Credit Summary - 2005 Page 2

ADVERTISEMENT

Page 2

CD-425

Web

FEIN

Legal Name

10-05

Part 4.

Computation of Income Tax Credits Taken in 2005

,

,

.

.

20

N.C. net income tax due

20.

(From Form CD-405, Schedule B, Line 26 or CD-401S, Schedule B, Line 22)

00

,

,

.

21. Add Lines 11 through 17, enter result here

21.

00

,

,

.

22. Enter the lesser of Line 20 or 21

22.

00

,

,

.

23. Total income tax credits subject to 50% of tax limit taken in 2005

23.

00

(From Form NC-478, Part 3, Line 31)

,

,

.

24. Enter amount from Line 18

24.

00

,

,

.

25.

25. Add Lines 22 through 24

00

,

,

.

26.

26. Add Lines 14 and 15, enter result here

00

,

,

.

27. Income tax credits subject to G.S. 105-130.5(a)(10) adjustment

27.

00

Subtract Line 26 from Line 25

28. Income Tax Credit Adjustment

(C Corporations complete Line 28a.

S Corporations with nonresident shareholders filing composite, complete Line 28b.)

,

,

.

a. C Corporation adjustment

28a.

00

Multiply Line 27 by 6.90%

b.

S Corporation adjustment

If only one nonresident shareholder is filing composite or if all shareholders

,

,

.

filing composite are subject to the same tax rate, multiply Line 27 by the

28b.

00

current individual income tax rate used to calculate N.C. income tax. (See

Form CD-401S, Schedule B, Line 22) Note: If there is more than one

nonresident shareholder filing composite and all shareholders

are not subject to the same income tax rate, see worksheet in

instructions for adjustment computation.

29.

Total Income Tax Credits Taken in 2005

,

,

.

C Corporations subtract Line 28a from Line 25, enter result here and on

29.

00

Form CD-405, Schedule B, Line 27. S Corporations with nonresident

shareholders filing composite subtract Line 28b from Line 25, enter result

here and on Form CD-401S, Schedule B, Line 23.

Part 5.

Expenses Incurred for Which the First Installment of a Historic Rehabilitation Tax Credit is Taken in 2005

(Complete Lines 30 and 31 only if a tax credit on Part 3, Line 11 or Line 12 is taken.)

.

,

,

,

30.

Enter the amount of qualified rehabilitation expenditures for

30.

00

which the income-producing credit on Line 11 is taken.

,

,

,

.

31.

Enter the amount of rehabilitation expenses for which the

31.

00

nonincome-producing credit on Line 12 is taken.

Form CD-425 must be attached to the last page of Form CD-405 or CD-401S if a tax credit is claimed.

Failure to substantiate a tax credit may result in the disallowance of that credit.

CD

425

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2