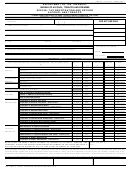

SECTION III - BUSINESS REGISTRATION

10. OWNERSHIP INFORMATION:

INDIVIDUAL OWNER

PARTNERSHIP

CORPORATION

LLC

____________

OTHER ( Specify)

(Check One Box Only)

11. OWNERSHIP RESPONSIBILITY: (Read instruction sheet; use a separate sheet of paper if additional space is needed.)

FULL NAME

ADDRESS

POSITION

FULL NAME

ADDRESS

POSITION

FULL NAME

ADDRESS

POSITION

FULL NAME

ADDRESS

POSITION

FULL NAME

ADDRESS

POSITION

GROSS RECEIPTS less than $500,000 (See instructions for reduced rate taxpayers on the instruction sheet below.)

12.

DATE OF CHANGE (mm, dd, yyyy)

13.

NEW BUSINESS (NOTE: RETAILERS AND WHOLESALERS SHOW DATE ALCOHOLIC

BEVERAGE SALES BEGAN; PRODUCERS, MANUFACTURERS , AND USERS SHOW DA TE

BUSINESS COMMENCED)

14.

EXISTING BUSINESS WITH CHANGE IN:

DATE OF CHANGE (mm, dd, yyyy)

(a) NAME/TRADE NAME (Indicate)

DATE OF CHANGE (mm, dd, yyyy )

(b) ADDRESS (Indicate)

(c) OWNERSHIP (Indicate)

DATE OF CHANGE (mm, dd, yyyy)

(d) EMPLOYER IDENTIFICATION NUMBER

DATE OF CHANGE (mm, dd, yyyy)

(OLD:

NEW:

)

(e) BUSINESS TELEPHONE NUMBER

(

)

15.

DISCONTINUED BUSINESS

DATE BUSINESS DISCONTINUED (mm, dd, yyyy)

PAPERWORK REDUCTION ACT NOTICE

This request is in accordance with the Paperwork Reduction Act of 1995. This information is used to ensure compliance by taxpayers of P.L. 100-647,

Technical Corrections Act of 1988, and the Internal Revenue Laws of the United States. This information collection is used to determine and collect the

right amount of tax.

The estimated average burden associated with this collection of information is .8 hour per respondent or recordkeeper, depending on individual circum-

stances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be addressed to Reports Management

Officer, Regulations and Rulings Division, Alcohol and Tobacco Tax and Trade Bureau, Washington, D.C. 20220.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a current valid OMB control

number.

(SEE INSTRUCTION SHEET)

TTB F 5630.5 (10/2006)

Page 2 of 2

1

1 2

2