Instructions For Form D-2210 - Underpayment Of Estimated Income Tax By Individuals

ADVERTISEMENT

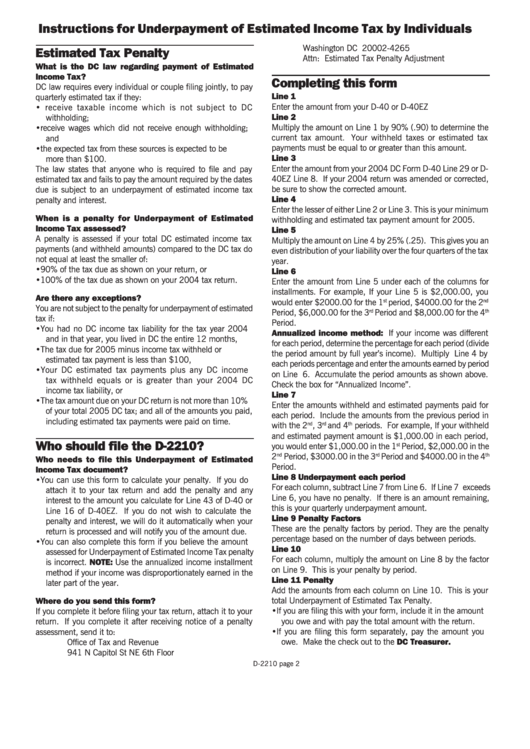

Instructions for Underpayment of Estimated Income Tax by Individuals

Washington DC 20002-4265

Estimated Tax Penalty

Attn: Estimated Tax Penalty Adjustment

What is the DC law regarding payment of Estimated

Income Tax?

Completing this form

DC law requires every individual or couple filing jointly, to pay

quarterly estimated tax if they:

Line 1

Enter the amount from your D-40 or D-40EZ

• receive taxable income which is not subject to DC

withholding;

Line 2

Multiply the amount on Line 1 by 90% (.90) to determine the

• receive wages which did not receive enough withholding;

current tax amount. Your withheld taxes or estimated tax

and

payments must be equal to or greater than this amount.

• the expected tax from these sources is expected to be

more than $100.

Line 3

Enter the amount from your 2004 DC Form D-40 Line 29 or D-

The law states that anyone who is required to file and pay

40EZ Line 8. If your 2004 return was amended or corrected,

estimated tax and fails to pay the amount required by the dates

be sure to show the corrected amount.

due is subject to an underpayment of estimated income tax

penalty and interest.

Line 4

Enter the lesser of either Line 2 or Line 3. This is your minimum

withholding and estimated tax payment amount for 2005.

When is a penalty for Underpayment of Estimated

Income Tax assessed?

Line 5

A penalty is assessed if your total DC estimated income tax

Multiply the amount on Line 4 by 25% (.25). This gives you an

payments (and withheld amounts) compared to the DC tax do

even distribution of your liability over the four quarters of the tax

not equal at least the smaller of:

year.

• 90% of the tax due as shown on your return, or

Line 6

• 100% of the tax due as shown on your 2004 tax return.

Enter the amount from Line 5 under each of the columns for

installments. For example, If your Line 5 is $2,000.00, you

Are there any exceptions?

would enter $2000.00 for the 1

period, $4000.00 for the 2

st

nd

You are not subject to the penalty for underpayment of estimated

Period, $6,000.00 for the 3

Period and $8,000.00 for the 4

rd

th

tax if:

Period.

• You had no DC income tax liability for the tax year 2004

Annualized income method: If your income was different

and in that year, you lived in DC the entire 12 months,

for each period, determine the percentage for each period (divide

• The tax due for 2005 minus income tax withheld or

the period amount by full year’s income). Multiply Line 4 by

estimated tax payment is less than $100,

each periods percentage and enter the amounts earned by period

• Your DC estimated tax payments plus any DC income

on Line 6. Accumulate the period amounts as shown above.

tax withheld equals or is greater than your 2004 DC

Check the box for “Annualized Income”.

income tax liability, or

Line 7

• The tax amount due on your DC return is not more than 10%

Enter the amounts withheld and estimated payments paid for

of your total 2005 DC tax; and all of the amounts you paid,

each period. Include the amounts from the previous period in

including estimated tax payments were paid on time.

with the 2

, 3

and 4

periods. For example, If your withheld

nd

rd

th

and estimated payment amount is $1,000.00 in each period,

you would enter $1,000.00 in the 1

Period, $2,000.00 in the

Who should file the D-2210?

st

2

Period, $3000.00 in the 3

Period and $4000.00 in the 4

nd

rd

th

Who needs to file this Underpayment of Estimated

Period.

Income Tax document?

Line 8 Underpayment each period

• You can use this form to calculate your penalty. If you do

For each column, subtract Line 7 from Line 6. If Line 7 exceeds

attach it to your tax return and add the penalty and any

Line 6, you have no penalty. If there is an amount remaining,

interest to the amount you calculate for Line 43 of D-40 or

this is your quarterly underpayment amount.

Line 16 of D-40EZ. If you do not wish to calculate the

Line 9 Penalty Factors

penalty and interest, we will do it automatically when your

These are the penalty factors by period. They are the penalty

return is processed and will notify you of the amount due.

percentage based on the number of days between periods.

• You can also complete this form if you believe the amount

Line 10

assessed for Underpayment of Estimated Income Tax penalty

For each column, multiply the amount on Line 8 by the factor

is incorrect. NOTE: Use the annualized income installment

on Line 9. This is your penalty by period.

method if your income was disproportionately earned in the

Line 11 Penalty

later part of the year.

Add the amounts from each column on Line 10. This is your

total Underpayment of Estimated Tax Penalty.

Where do you send this form?

• If you are filing this with your form, include it in the amount

If you complete it before filing your tax return, attach it to your

you owe and with pay the total amount with the return.

return. If you complete it after receiving notice of a penalty

• If you are filing this form separately, pay the amount you

assessment, send it to:

owe. Make the check out to the DC Treasurer.

Office of Tax and Revenue

941 N Capitol St NE 6th Floor

D-2210 page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1