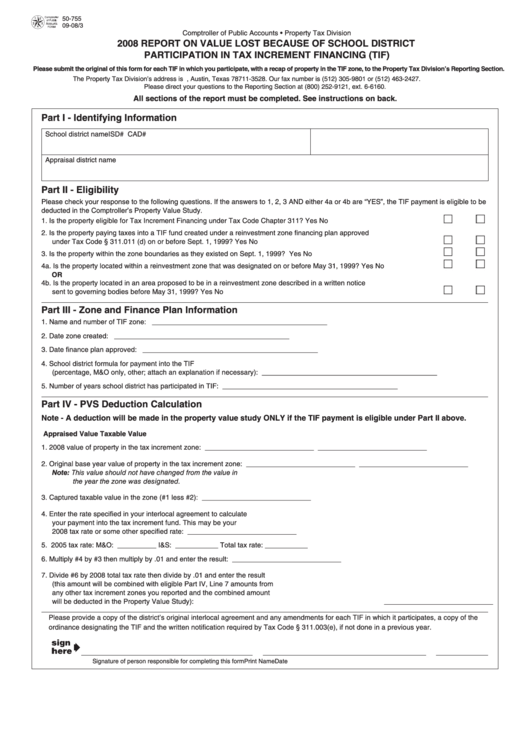

50-755

09-08/3

Comptroller of Public Accounts • Property Tax Division

2008 REPORT ON VALUE LOST BECAUSE OF SCHOOL DISTRICT

PARTICIPATION IN TAX INCREMENT FINANCING (TIF)

Please submit the original of this form for each TIF in which you participate, with a recap of property in the TIF zone, to the Property Tax Division’s Reporting Section.

The Property Tax Division’s address is P.O. Box 13528, Austin, Texas 78711-3528. Our fax number is (512) 305-9801 or (512) 463-2427.

Please direct your questions to the Reporting Section at (800) 252-9121, ext. 6-6160.

All sections of the report must be completed. See instructions on back.

Part I - Identifying Information

School district name

ISD# CAD#

Appraisal district name

Part II - Eligibility

Please check your response to the following questions. If the answers to 1, 2, 3 AND either 4a or 4b are “YES” , the TIF payment is eligible to be

deducted in the Comptroller’s Property Value Study.

1. Is the property eligible for Tax Increment Financing under Tax Code Chapter 311?

Yes

No

2. Is the property paying taxes into a TIF fund created under a reinvestment zone financing plan approved

under Tax Code § 311.011 (d) on or before Sept. 1, 1999?

Yes

No

3. Is the property within the zone boundaries as they existed on Sept. 1, 1999?

Yes

No

4a. Is the property located within a reinvestment zone that was designated on or before May 31, 1999?

Yes

No

OR

4b. Is the property located in an area proposed to be in a reinvestment zone described in a written notice

sent to governing bodies before May 31, 1999?

Yes

No

Part III - Zone and Finance Plan Information

1. Name and number of TIF zone:

_____________________________________________

2. Date zone created:

_____________________________________________

3. Date finance plan approved:

_____________________________________________

4. School district formula for payment into the TIF

(percentage, M&O only, other; attach an explanation if necessary):

_____________________________________________

5. Number of years school district has participated in TIF:

_____________________________________________

Part IV - PVS Deduction Calculation

Note - A deduction will be made in the property value study ONLY if the TIF payment is eligible under Part II above.

Appraised Value

Taxable Value

1. 2008 value of property in the tax increment zone:

____________________________

____________________________

2. Original base year value of property in the tax increment zone:

____________________________

____________________________

Note: This value should not have changed from the value in

the year the zone was designated.

3. Captured taxable value in the zone (#1 less #2):

____________________________

4. Enter the rate specified in your interlocal agreement to calculate

your payment into the tax increment fund. This may be your

2008 tax rate or some other specified rate:

____________________________

5. 2005 tax rate:

M&O: __________

I&S: ___________ Total tax rate: ___________

6. Multiply #4 by #3 then multiply by .01 and enter the result:

____________________________

7. Divide #6 by 2008 total tax rate then divide by .01 and enter the result

(this amount will be combined with eligible Part IV, Line 7 amounts from

any other tax increment zones you reported and the combined amount

will be deducted in the Property Value Study):

____________________________

Please provide a copy of the district’s original interlocal agreement and any amendments for each TIF in which it participates, a copy of the

ordinance designating the TIF and the written notification required by Tax Code § 311.003(e), if not done in a previous year.

Signature of person responsible for completing this form

Print Name

Date

1

1 2

2