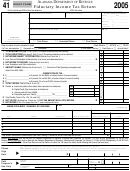

Form D-41 - Fiduciary Income Tax Forms And Instructions - 2005 D Page 5

ADVERTISEMENT

Fiduciary

How can you avoid penalties and

A person or business with the power to act for another and the

interest?

responsibility for managing the assets and income of an estate

or trust. A fiduciary may be a trustee, an administrator of an

File your return on time

estate, a business adviser, attorney, guardian, real estate agent,

There is a 5% per-month penalty for failure to file a return or pay

banker, stockbroker, or title company.

any tax due on time. The penalty is calculated on the unpaid tax

Grantor

for each month or part of the month that the return is not filed or

The person who creates a trust and transfers the title of the

the tax is not paid. The maximum penalty is an amount equal to

property and assets to another. That person may also be called

25% of the tax due.

“trustor,” “settlor,” or “donor.”

You will be charged interest of 10% per year, compounded daily,

Resident estate

on any amount (including penalty and accrued interest) not paid

If the deceased was a DC resident at the time of death, then his

on time. Interest is calculated from the due date of the return

or her estate is a DC resident estate.

to the date when the outstanding balance is paid.

Trust

Do not understate your taxes

An entity created to hold assets for the benefit of certain people

There is a 20% penalty on any understated amount of taxes

or entities.

due if:

Simple trust

• The unpaid amount is more than 10% of the actual amount

One which requires that all income be distributed each year

due; or

rather than being accumulated.

• The unpaid amount is $2,000 or more.

Complex trust

One that does not qualify as a simple trust.

Tax preparers must pay a penalty for understating taxes due to

Testamentary (created by will)

any of the following reasons:

One created by a will and comes into existence at the time of

• The refund or amount due is based on unrealistic information;

the creator’s death.

• The preparer should have been aware of a relevant law or

Inter vivos (living)

regulation; or

One which comes into existence during the lifetime of the per-

• Relevant facts about the return are not adequately disclosed.

son who created it. Often the trust is for a minor or someone

Penalties range from $250 to $10,000.

else who is unable to administer his or her own assets.

Resident trust

Payment

A trust is a resident trust if:

Include a check or money order payable to the DC Treasurer

with the completed return. Write the estate or trust SSN/FEIN,

• The person who created the testamentary trust was a DC

and “2005 D-41” on the payment. You may not pay by credit

resident at the time of death; or

card.

• The creator of an inter vivos trust was a DC resident at the

time the trust was created; or

Make sure your check will clear

You will be charged a $65 fee if your check is returned to us.

• If the trust consists of property of a DC resident; or

• The trust results from the dissolution of a corporation orga-

nized under DC laws.

Explanation of terms

The residence of the fiduciary does not determine whether the

Beneficiary

the trust is resident or nonresident.

Any person who is to receive profits or distributions from an

estate or trust.

Estate

All the property and assets of one who has died. An estate comes

into existence at the time of an individual’s death and continues

until the final distribution of its assets to the beneficiaries.

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8