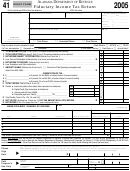

Form D-41 - Fiduciary Income Tax Forms And Instructions - 2005 D Page 6

ADVERTISEMENT

Instructions for the D-41

Service adjusted your federal 1041 after you filed a D-41, you

must file an amended D-41 within 90 days of receiving notice of

the federal adjustment. Include a copy of the federal adjust-

Getting started

ment.

Entity type

• You’ll need a copy of your completed 2005 federal Form 1041

Fill in the oval that describes the entity for which you are filing.

and a calculator to complete this form.

• You may copy many amounts directly from the Form 1041.

Trust type

Please be careful since the line numbers differ from Form

Fill in the oval that describes the trust type.

D-41 line numbers.

• Not all items will apply to you. Fill in only those that apply.

Income

If an amount is zero, leave the line blank.

• Round cents to the nearest dollar.

Line 1 Federal total income

$10,500.50 rounds up to $10,501

Example:

Enter the amount from your federal Form 1041, Line 9.

$10,500.49 rounds down to $10,500

Line 2 Additions to federal total income

• If the trust/estate does not have an identification number,

This is income, if any, that is not taxed by the federal

please provide the social security number of the owner/dece-

government and deductions taken and not allowed by DC. You

dent.

must add these items back to your federal total income to fig-

• If you do not need to file again for this entity fill in the “final

ure your DC tax. Complete Calculation A below.

return” oval.

NOTE:

Unlike the Federal Government, DC does not allow the

additional 30% or 50% bonus depreciation nor the additional

IRC section 179 expenses. Therefore, any such amounts claimed

Fiduciary information

on a federal tax return cannot be claimed on the DC return.

Amended return

Also, the Net Operating Loss Carryback allowed for federal tax

If you are filing an amended return, fill in the amended return

purposes is not allowed for DC tax purposes.

oval and complete the D-41 with the correct information. At-

Line 4 Subtractions from federal total income

tach an explanation of any adjustments. If the Internal Revenue

This is income, if any, that DC does not tax. Subtract it from

your federal total income. Complete Calculation B below.

Calculation A Additions to your federal total income

a Franchise tax deduction used to calculate business income or loss

That amount included on federal Form 1040 Schedule C, Line 23 or Form 1040 Schedule C-EZ Line 2.

b Franchise tax deduction used to calculate income from rental real estate, royalties,

partnerships, trusts etc.

That amount included on federal Form 1065, Line 14 or on federal

Form 1041, Line 11.

c Deductions for an S corporation from Schedule K-1 of federal Form 1120S

Includes amount entered on Lines 8–11 and 14a of Schedule K-1. NOTE: IRC Sec. 179 expenses are

deductible up to $25,000. A QHTC may deduct up to $40,000.

d Income distributions eligible for income averaging on your federal tax return from

federal Form 4972, Lines 6 and 8

Add Lines 6 and 8, enter here.

e Any 30% or 50% bonus depreciation claimed on the federal return.

f Total additions

Add Lines a–e, enter here and on D-41, Line 2.

Calculation B Subtractions from your federal total income

a Taxable interest from U.S. Treasury bonds and other U.S. obligations

That amount included in your federal Form 1040 or 1040A, Line 8a or 1040EZ, Line 2.

Also see your federal Form 1099INT, Line 3.

b Taxable amount of social security and tier 1 railroad retirement income

From federal Form 1040, Line 20b or 1040A, Line 14b.

c Income reported and taxed on a DC franchise return

If the income reported on your federal Form 1040 included any income reported and taxed on a

Form D-20 or D-30 (DC Franchise Tax Return), enter it here.

d Total subtractions

Add Lines a–c and enter here and on D-41, Line 4.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8