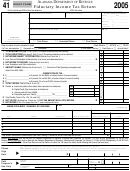

Form D-41 - Fiduciary Income Tax Forms And Instructions - 2005 D Page 8

ADVERTISEMENT

Instructions for Form FR-127F

Why file the FR-127F?

You should file this form if you cannot file the fiduciary income tax return by the due date. By filing this form, you can receive a 6-month

extension of time to file. A filing extension is not an extension of the due date for paying any tax you may owe. Before filing for an extension,

you should estimate the taxes you will owe and pay that amount with the FR-127F by the due date of the D-41 return.

Additional extension for DC residents living or traveling outside the United States.

In addition to the 6-month extension, you may receive an additional 6-month extension if you are living or traveling outside the United

States. You must file for the first 6-month extension by the due date before applying for the additional extension of time to file. You must use

Form FR-127F to request an extension of time to file a DC fiduciary return.

When is the Form FR-127F due?

•

Calendar year filers: you must submit your request along with payment in full of any tax due by April 18, 2006.

•

Fiscal year filers: you must submit your request along with payment in full of any tax due by the 15th day of the fourth month after the

end of your fiscal year.

When you have received an extension, when is your fiduciary income tax return due?

You may file your tax return any time before the extension expires.

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8