Form M-706 - Massachusetts Estate Tax Return - 2016 Page 2

ADVERTISEMENT

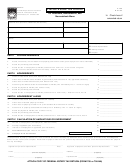

FORM M-706, PAGE 2

Name of decedent

Date of death (mm/dd/yyyy)

Social Security number

3

3

3

01 Marital status at time of death:

Single

Married

Widow or widower

01a

Name of deceased spouse

01b

1c

Social Security number of deceased spouse

Date of death of deceased spouse (mm/dd/yyyy)

12 Fill in if there was any insurance on the decedent’s life that is not included in the gross estate (attach Form(s) 712 for life insurance). . . . . . . . . . .

13 Fill in if at time of death the decedent owned any property as a joint tenant with rights of survivorship in which: one or more of the other joint

tenants was someone other than the decedent’s spouse and less than the full value of the property is included on the return as part of gross

estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 Fill in if at time of death the decedent owned any interest in a partnership or unincorporated business or any stock in an inactive or closely

held corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 Fill in if the decedent made any transfer under Internal Revenue Code sections 2035, 2036, 2037 or 2038 in which an asset has been excluded

from the gross estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Fill in if during the decedent’s lifetime any gifts were made in excess of the annual exclusion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16a Fill in if U.S. Form 709 was filed with the IRS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Fill in if the estate elects to make a Qualified Terminable Interest Property (QTIP) deduction under Internal Revenue Code Section 2056(a) . . . . . .

18 Fill in if the decedent was ever the beneficiary of a QTIP trust for which a deduction was claimed by the estate of a pre-deceased spouse under

Internal Revenue Code section 2056(b)(7) and which is not reported on this return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 Fill in if the estate elects alternate valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Fill in if the estate elects special use valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part 1. Tentative Massachusetts estate tax

01 Total gross estate (from page 1, line 1 of U.S. Form 706 with a revision date of July 1999 or from Part 5, line 12 of

this return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

02 Total allowable deductions (from page 1, line 2 of U.S. Form 706 with a revision date of July 1999 or from Part 6,

line 11 of this return). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

03 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

04 Adjusted taxable gifts (from page 1, line 4 of U.S. Form 706 with a revision date of July 1999). . . . . . . . . . . . . . . . . . . . . 4

05 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

06 Credit for state death taxes (from page 1, line 15 of U.S. Form 706 with a revision date of July 1999) . . . . . . . . . . . . . . . 6

Part 2. Computation of tax for estate of Massachusetts resident decedent with property

in another state

01 Total gross estate, wherever situated. Enter the amount from Part 1, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

02 Credit for state death taxes. Enter amount from Part 1, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

03 Estate or inheritance taxes actually paid to other states. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

04 Gross value of real estate and tangible personal property in other states . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

05 Percentage of estate in other states. Divide line 4 by line 1. Note: Complete computation to six decimal places . . . . . . . 5

06 Prorated credit. Multiply line 2 by line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

07 Deduction allowable for taxes paid to other states. Enter the smaller of line 3 or line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

08 Massachusetts estate tax. Subtract line 7 from line 2. Enter here and in Part 4, line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5