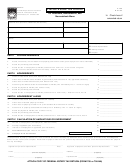

Form M-706 - Massachusetts Estate Tax Return - 2016 Page 4

ADVERTISEMENT

FORM M-706, PAGE 4

Name of decedent

Date of death (mm/dd/yyyy)

Social Security number

3

3

3

Part 6. Total allowable deductions.

Schedule references are to the schedules of the U.S. Form 706 with a revision date of July

1999 which must be completed and submitted with this return whether or not a current federal estate tax return, U.S. Form 706, is required to be filed.

01 Schedule J: Funeral expenses and expenses incurred in administering property subject to claims . . . . . . . . . . . . . . . . . . 1

02 Schedule K: Debts of the decedent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

03 Schedule K: Mortgages and liens . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

04 Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

05 Amount of allowable deduction from line 4 (see IRC Section 2053(c)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

06 Schedule L: Net losses during administration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

07 Schedule L: Expenses incurred in administering property not subject to claims . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

08 Schedule M: Bequests, etc. to surviving spouse. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

09 Schedule O: Charitable, public and similar gifts and bequests. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Schedule T: Qualified family-owned business interest deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total allowable deductions (add lines 5 through 10). Enter here and on line 2 of Part 1, Tentative Massachusetts

estate tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5