Schedule Wv/aif-1 - Credit Fr Aerospace Industrial Facility Investments - 2000

ADVERTISEMENT

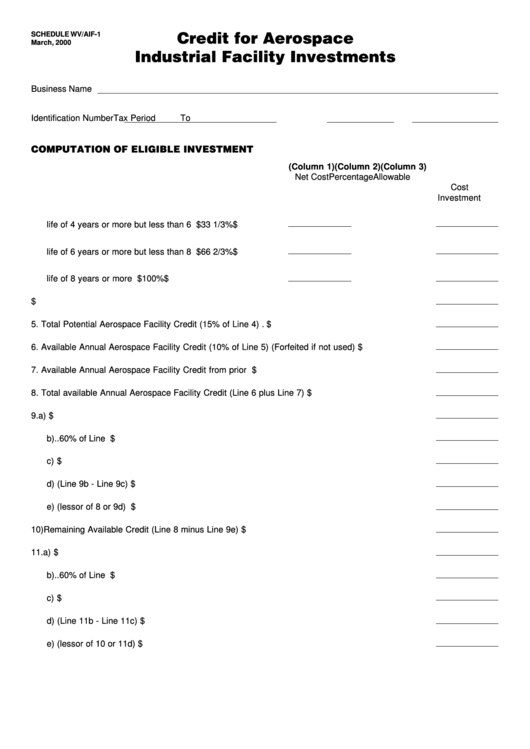

Credit for Aerospace

SCHEDULE WV/AIF-1

March, 2000

Industrial Facility Investments

Business Name

Identification Number

Tax Period

To

COMPUTATION OF ELIGIBLE INVESTMENT

(Column 1)

(Column 2)

(Column 3)

Net Cost

Percentage

Allowable

Cost

Investment

1. Expansion or Revitalization property with useful

life of 4 years or more but less than 6 years ......................... $

33 1/3%

$

2. Expansion or Revitalization property with useful

life of 6 years or more but less than 8 years ......................... $

66 2/3%

$

3. Expansion or Revitalization property with useful

life of 8 years or more ........................................................... $

100%

$

4. Total Eligible Expansion or Revitalization Investment ....................................................................... $

5. Total Potential Aerospace Facility Credit (15% of Line 4) .................................................................... $

6. Available Annual Aerospace Facility Credit (10% of Line 5) (Forfeited if not used) ............................ $

7. Available Annual Aerospace Facility Credit from prior years ............................................................... $

8. Total available Annual Aerospace Facility Credit (Line 6 plus Line 7) ................................................. $

9. a) .. Total Business Franchise Tax ...................................................................................................... $

b) .. 60% of Line 9a ............................................................................................................................. $

c) .. Other Credits Claimed ................................................................................................................. $

d) .. Net Limit (Line 9b - Line 9c) ........................................................................................................ $

e) .. Amount of Aerospace Credit (lessor of 8 or 9d) .......................................................................... $

10) Remaining Available Credit (Line 8 minus Line 9e) ........................................................................... $

11. a) .. Total Corporation Net Income Tax ............................................................................................... $

b) .. 60% of Line 11a ........................................................................................................................... $

c) .. Other Credits Claimed ................................................................................................................. $

d) .. Net Limit (Line 11b - Line 11c) ..................................................................................................... $

e) .. Amount of Aerospace Credit (lessor of 10 or 11d) ....................................................................... $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2