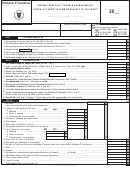

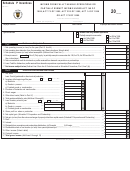

Schedule P Incentives - Income From Fully Taxable Operations Or Partially Exempt Income Under Act 148 Of 1988, Act 75 Of 1995, Act 225 Of 1995, Act 14 Of 1996 Or Act 178 Of 2000 - 2011 Page 2

ADVERTISEMENT

Rev. 03.11

Schedule P Incentives - Page 2

Part III

Deductions and Net Operating Income

00

18.

Compensation to officers .......................................................................................................

(18)

00

19.

Salaries, commissions and bonuses to employees ...................................................................

(19)

00

20.

Commissions to businesses ..................................................................................................

(20)

00

21.

Social security tax (FICA) ....................................................................................................

(21)

00

22.

Unemployment tax ..............................................................................................................

(22)

00

23.

State Insurance Fund premiums .............................................................................................

(23)

00

24.

Medical or hospitalization insurance ........................................................................................

(24)

00

25.

Insurance ...........................................................................................................................

(25)

00

26.

Interest ...............................................................................................................................

(26)

00

27.

Rent ...................................................................................................................................

(27)

00

28.

Property tax: (a) Personal _______________ (b) Real _______________ ...................................

(28)

00

29.

Other taxes, patents and licenses (Submit detail) ......................................................................

(29)

00

30.

Losses from fire, storms, theft or other casualties .......................................................................

(30)

00

31.

Motor vehicles expenses (Do not include depreciation) ..............................................................

(31)

00

32.

Meals and entertainment expenses (Total ____________) (See instructions) .....................................

(32)

00

33.

Travel expenses ..................................................................................................................

(33)

00

34.

Professional services ...........................................................................................................

(34)

00

35.

Contributions to pension or other qualified plans

......

(See instructions. Submit Schedule F Incentives)

(35)

00

36.

Depreciation (See instructions. Submit Schedule E) ..................................................................

(36)

00

37.

Flexible depreciation (See instructions. Submit Schedule E) .......................................................

(37)

00

38.

Accelerated depreciation (See instructions. Submit Schedule E) .................................................

(38)

00

39.

Bad debts (See instructions. Submit detail) ...............................................................................

(39)

00

40.

Charitable contributions .........................................................................................................

(40)

00

41.

Repairs ...............................................................................................................................

(41)

00

42.

Other deductions (See instructions. Submit detail) .....................................................................

(42)

00

43.

Total deductions (Add lines 18 through 42) ............................................................................................................................

(43)

44.

Net operating income (or loss) for the year (Subtract line 43 from line 17. Enter in Part I, line 1) ................................................

(44)

00

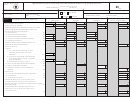

Part IV

Other Direct Costs

00

00

9.

Utilities ...........................................................

(9)

1.

Salaries, wages and bonuses ...........................

(1)

00

00

10.

Current depreciation (Schedule E) ......................

(10)

2.

Social security tax (FICA) ...............................

(2)

00

00

11.

Flexible depreciation (Schedule E) .....................

(11)

3.

Unemployment tax ..........................................

(3)

00

00

12.

Accelerated depreciation (Schedule E) ................

(12)

4.

State Insurance Fund premiums ........................

(4)

00

00

13.

Other expenses (Submit detail) ..........................

(13)

5.

Medical or hospitalization insurance ....................

(5)

00

14.

Total other direct costs (Add lines 1 through 13.

6.

Other insurance ...............................................

(6)

00

00

Enter here and in Part II, line 5) .........................

(14)

7.

Excise taxes ..................................................

(7)

00

8.

Repairs ..........................................................

(8)

Retention

Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2