Exemption Eligibility Checklist - 2012

ADVERTISEMENT

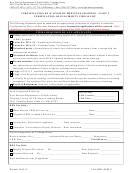

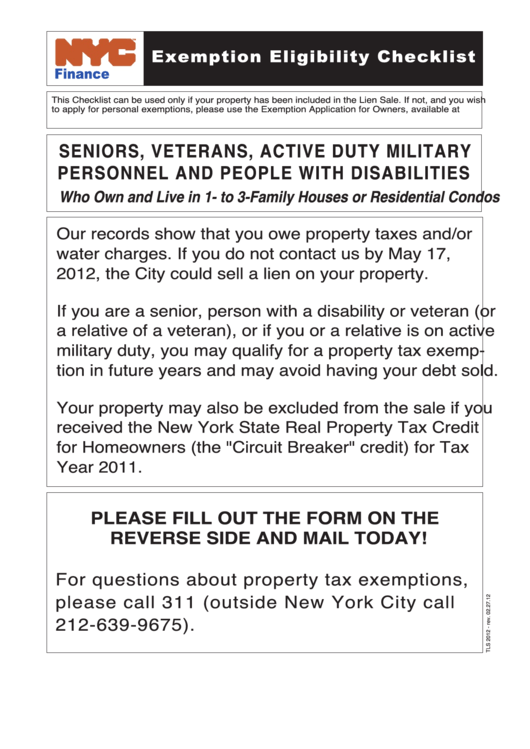

Exemption Eligibility Checklist

TM

Finance

This Checklist can be used only if your property has been included in the Lien Sale. If not, and you wish

to apply for personal exemptions, please use the Exemption Application for Owners, available at

nyc.gov/finance or by calling 311.

SENIORS, VETERANS, ACTIVE DUTY MILITARY

PERSONNEL AND PEOPLE WITH DISABILITIES

Who Own and Live in 1- to 3-Family Houses or Residential Condos

Our records show that you owe property taxes and/or

water charges. If you do not contact us by May 17,

2012, the City could sell a lien on your property.

If you are a senior, person with a disability or veteran (or

a relative of a veteran), or if you or a relative is on active

military duty, you may qualify for a property tax exemp-

tion in future years and may avoid having your debt sold.

Your property may also be excluded from the sale if you

received the New York State Real Property Tax Credit

for Homeowners (the "Circuit Breaker" credit) for Tax

Year 2011.

PLEASE FILL OUT THE FORM ON THE

REVERSE SIDE AND MAIL TODAY!

For questions about property tax exemptions,

please call 311 (outside New York City call

212-639-9675).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2