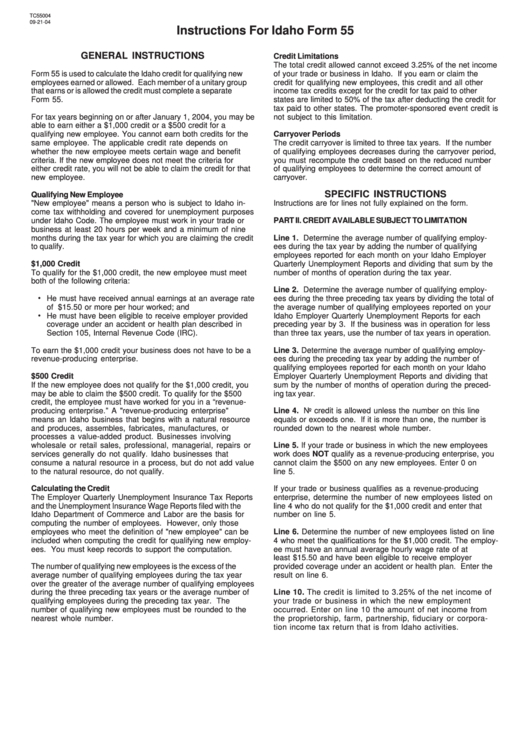

Instructions For Idaho Form 55 - 2004

ADVERTISEMENT

TC55004

09-21-04

Instructions For Idaho Form 55

GENERAL INSTRUCTIONS

Credit Limitations

The total credit allowed cannot exceed 3.25% of the net income

Form 55 is used to calculate the Idaho credit for qualifying new

of your trade or business in Idaho. If you earn or claim the

employees earned or allowed. Each member of a unitary group

credit for qualifying new employees, this credit and all other

that earns or is allowed the credit must complete a separate

income tax credits except for the credit for tax paid to other

Form 55.

states are limited to 50% of the tax after deducting the credit for

tax paid to other states. The promoter-sponsored event credit is

For tax years beginning on or after January 1, 2004, you may be

not subject to this limitation.

able to earn either a $1,000 credit or a $500 credit for a

qualifying new employee. You cannot earn both credits for the

Carryover Periods

same employee. The applicable credit rate depends on

The credit carryover is limited to three tax years. If the number

whether the new employee meets certain wage and benefit

of qualifying employees decreases during the carryover period,

criteria. If the new employee does not meet the criteria for

you must recompute the credit based on the reduced number

of qualifying employees to determine the correct amount of

either credit rate, you will not be able to claim the credit for that

new employee.

carryover.

SPECIFIC INSTRUCTIONS

Qualifying New Employee

"New employee" means a person who is subject to Idaho in-

Instructions are for lines not fully explained on the form.

come tax withholding and covered for unemployment purposes

under Idaho Code. The employee must work in your trade or

PART II. CREDIT AVAILABLE SUBJECT TO LIMITATION

business at least 20 hours per week and a minimum of nine

months during the tax year for which you are claiming the credit

Line 1. Determine the average number of qualifying employ-

to qualify.

ees during the tax year by adding the number of qualifying

employees reported for each month on your Idaho Employer

$1,000 Credit

Quarterly Unemployment Reports and dividing that sum by the

To qualify for the $1,000 credit, the new employee must meet

number of months of operation during the tax year.

both of the following criteria:

Line 2. Determine the average number of qualifying employ-

•

He must have received annual earnings at an average rate

ees during the three preceding tax years by dividing the total of

of $15.50 or more per hour worked; and

the average number of qualifying employees reported on your

•

He must have been eligible to receive employer provided

Idaho Employer Quarterly Unemployment Reports for each

coverage under an accident or health plan described in

preceding year by 3. If the business was in operation for less

Section 105, Internal Revenue Code (IRC).

than three tax years, use the number of tax years in operation.

To earn the $1,000 credit your business does not have to be a

Line 3. Determine the average number of qualifying employ-

revenue-producing enterprise.

ees during the preceding tax year by adding the number of

qualifying employees reported for each month on your Idaho

$500 Credit

Employer Quarterly Unemployment Reports and dividing that

If the new employee does not qualify for the $1,000 credit, you

sum by the number of months of operation during the preced-

may be able to claim the $500 credit. To qualify for the $500

ing tax year.

credit, the employee must have worked for you in a “revenue-

producing enterprise.” A "revenue-producing enterprise"

Line 4. No credit is allowed unless the number on this line

means an Idaho business that begins with a natural resource

equals or exceeds one. If it is more than one, the number is

and produces, assembles, fabricates, manufactures, or

rounded down to the nearest whole number.

processes a value-added product. Businesses involving

wholesale or retail sales, professional, managerial, repairs or

Line 5. If your trade or business in which the new employees

services generally do not qualify. Idaho businesses that

work does NOT qualify as a revenue-producing enterprise, you

consume a natural resource in a process, but do not add value

cannot claim the $500 on any new employees. Enter 0 on

to the natural resource, do not qualify.

line 5.

Calculating the Credit

If your trade or business qualifies as a revenue-producing

The Employer Quarterly Unemployment Insurance Tax Reports

enterprise, determine the number of new employees listed on

and the Unemployment Insurance Wage Reports filed with the

line 4 who do not qualify for the $1,000 credit and enter that

Idaho Department of Commerce and Labor are the basis for

number on line 5.

computing the number of employees. However, only those

employees who meet the definition of "new employee" can be

Line 6. Determine the number of new employees listed on line

included when computing the credit for qualifying new employ-

4 who meet the qualifications for the $1,000 credit. The employ-

ees. You must keep records to support the computation.

ee must have an annual average hourly wage rate of at

least $15.50 and have been eligible to receive employer

The number of qualifying new employees is the excess of the

provided coverage under an accident or health plan. Enter the

average number of qualifying employees during the tax year

result on line 6.

over the greater of the average number of qualifying employees

during the three preceding tax years or the average number of

Line 10. The credit is limited to 3.25% of the net income of

qualifying employees during the preceding tax year. The

your trade or business in which the new employment

number of qualifying new employees must be rounded to the

occurred. Enter on line 10 the amount of net income from

nearest whole number.

the proprietorship, farm, partnership, fiduciary or corpora-

tion income tax return that is from Idaho activities.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2