Instructions For Completing The Petition For Reduction Of The Mandatory Estimated Payment Towards The 2004 Business Privilege Tax Form - Philadelphia Department Of Revenue

ADVERTISEMENT

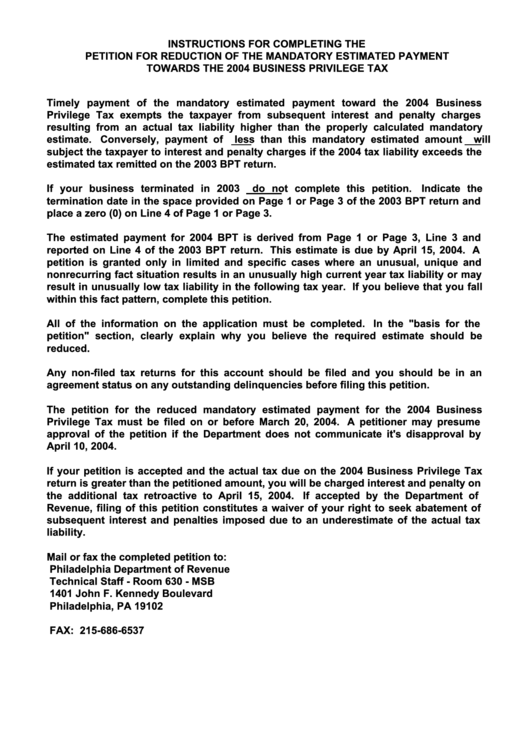

INSTRUCTIONS FOR COMPLETING THE

PETITION FOR REDUCTION OF THE MANDATORY ESTIMATED PAYMENT

TOWARDS THE 2004 BUSINESS PRIVILEGE TAX

Timely payment of the mandatory estimated payment toward the 2004 Business

Privilege Tax exempts the taxpayer from subsequent interest and penalty charges

resulting from an actual tax liability higher than the properly calculated mandatory

estimate.

Conversely, payment of less than this mandatory estimated amount will

subject the taxpayer to interest and penalty charges if the 2004 tax liability exceeds the

estimated tax remitted on the 2003 BPT return.

If your business terminated in 2003 do not complete this petition.

Indicate the

termination date in the space provided on Page 1 or Page 3 of the 2003 BPT return and

place a zero (0) on Line 4 of Page 1 or Page 3.

The estimated payment for 2004 BPT is derived from Page 1 or Page 3, Line 3 and

reported on Line 4 of the 2003 BPT return. This estimate is due by April 15, 2004. A

petition is granted only in limited and specific cases where an unusual, unique and

nonrecurring fact situation results in an unusually high current year tax liability or may

result in unusually low tax liability in the following tax year. If you believe that you fall

within this fact pattern, complete this petition.

All of the information on the application must be completed. In the "basis for the

petition" section, clearly explain why you believe the required estimate should be

reduced.

Any non-filed tax returns for this account should be filed and you should be in an

agreement status on any outstanding delinquencies before filing this petition.

The petition for the reduced mandatory estimated payment for the 2004 Business

Privilege Tax must be filed on or before March 20, 2004. A petitioner may presume

approval of the petition if the Department does not communicate it's disapproval by

April 10, 2004.

If your petition is accepted and the actual tax due on the 2004 Business Privilege Tax

return is greater than the petitioned amount, you will be charged interest and penalty on

the additional tax retroactive to April 15, 2004.

If accepted by the Department of

Revenue, filing of this petition constitutes a waiver of your right to seek abatement of

subsequent interest and penalties imposed due to an underestimate of the actual tax

liability.

Mail or fax the completed petition to:

Philadelphia Department of Revenue

Technical Staff - Room 630 - MSB

1401 John F. Kennedy Boulevard

Philadelphia, PA 19102

FAX: 215-686-6537

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1