Instructions For Form Pr-955

ADVERTISEMENT

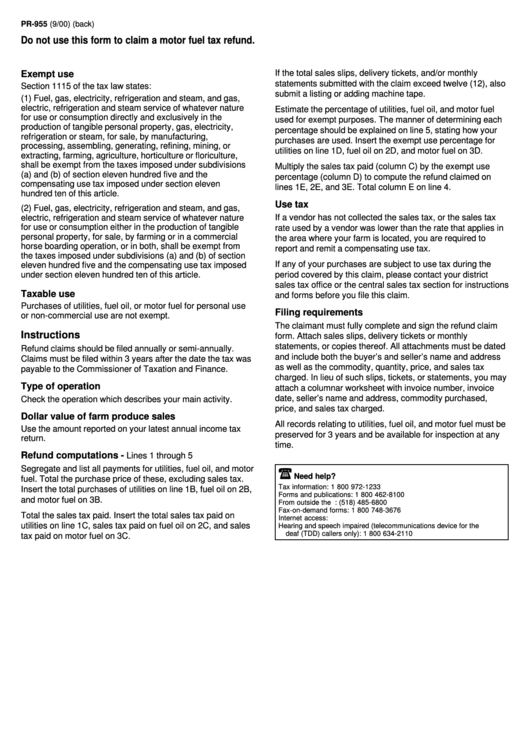

PR-955 (9/00) (back)

Do not use this form to claim a motor fuel tax refund.

If the total sales slips, delivery tickets, and/or monthly

Exempt use

statements submitted with the claim exceed twelve (12), also

Section 1115 of the tax law states:

submit a listing or adding machine tape.

(1) Fuel, gas, electricity, refrigeration and steam, and gas,

electric, refrigeration and steam service of whatever nature

Estimate the percentage of utilities, fuel oil, and motor fuel

for use or consumption directly and exclusively in the

used for exempt purposes. The manner of determining each

production of tangible personal property, gas, electricity,

percentage should be explained on line 5, stating how your

refrigeration or steam, for sale, by manufacturing,

purchases are used. Insert the exempt use percentage for

processing, assembling, generating, refining, mining, or

utilities on line 1D, fuel oil on 2D, and motor fuel on 3D.

extracting, farming, agriculture, horticulture or floriculture,

shall be exempt from the taxes imposed under subdivisions

Multiply the sales tax paid (column C) by the exempt use

(a) and (b) of section eleven hundred five and the

percentage (column D) to compute the refund claimed on

compensating use tax imposed under section eleven

lines 1E, 2E, and 3E. Total column E on line 4.

hundred ten of this article.

Use tax

(2) Fuel, gas, electricity, refrigeration and steam, and gas,

electric, refrigeration and steam service of whatever nature

If a vendor has not collected the sales tax, or the sales tax

for use or consumption either in the production of tangible

rate used by a vendor was lower than the rate that applies in

personal property, for sale, by farming or in a commercial

the area where your farm is located, you are required to

horse boarding operation, or in both, shall be exempt from

report and remit a compensating use tax.

the taxes imposed under subdivisions (a) and (b) of section

If any of your purchases are subject to use tax during the

eleven hundred five and the compensating use tax imposed

under section eleven hundred ten of this article.

period covered by this claim, please contact your district

sales tax office or the central sales tax section for instructions

Taxable use

and forms before you file this claim

.

Purchases of utilities, fuel oil, or motor fuel for personal use

Filing requirements

or non-commercial use are not exempt.

The claimant must fully complete and sign the refund claim

Instructions

form. Attach sales slips, delivery tickets or monthly

statements, or copies thereof. All attachments must be dated

Refund claims should be filed annually or semi-annually.

and include both the buyer’s and seller’s name and address

Claims must be filed within 3 years after the date the tax was

as well as the commodity, quantity, price, and sales tax

payable to the Commissioner of Taxation and Finance.

charged. In lieu of such slips, tickets, or statements, you may

Type of operation

attach a columnar worksheet with invoice number, invoice

date, seller’s name and address, commodity purchased,

Check the operation which describes your main activity.

price, and sales tax charged.

Dollar value of farm produce sales

All records relating to utilities, fuel oil, and motor fuel must be

Use the amount reported on your latest annual income tax

preserved for 3 years and be available for inspection at any

return.

time.

Refund computations -

Lines 1 through 5

Segregate and list all payments for utilities, fuel oil, and motor

Need help?

fuel. Total the purchase price of these, excluding sales tax.

Tax information: 1 800 972-1233

Insert the total purchases of utilities on line 1B, fuel oil on 2B,

Forms and publications: 1 800 462-8100

and motor fuel on 3B.

From outside the U.S. and outside Canada: (518) 485-6800

Fax-on-demand forms: 1 800 748-3676

Total the sales tax paid. Insert the total sales tax paid on

Internet access:

utilities on line 1C, sales tax paid on fuel oil on 2C, and sales

Hearing and speech impaired (telecommunications device for the

deaf (TDD) callers only): 1 800 634-2110

tax paid on motor fuel on 3C.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1