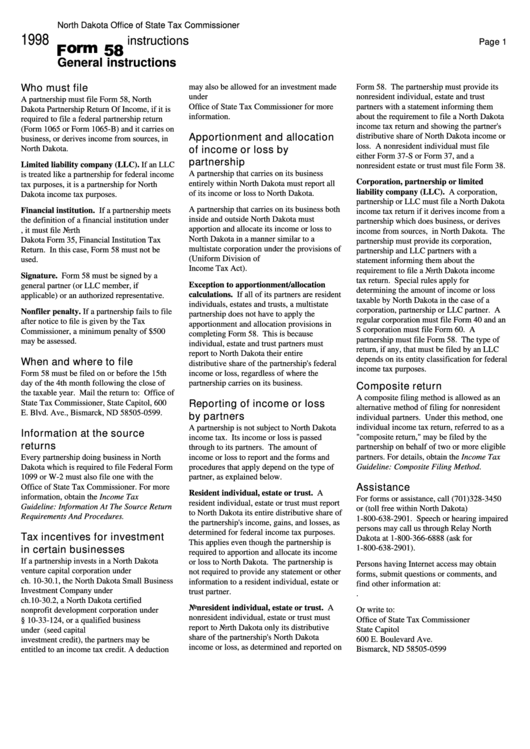

Form 58 Instructions - 1998

ADVERTISEMENT

North Dakota Office of State Tax Commissioner

1998

instructions

Page 1

General instructions

Who must file

may also be allowed for an investment made

Form 58. The partnership must provide its

under N.D.C.C. ch. 10-30.1. Contact the

nonresident individual, estate and trust

A partnership must file Form 58, North

Office of State Tax Commissioner for more

partners with a statement informing them

Dakota Partnership Return Of Income, if it is

information.

about the requirement to file a North Dakota

required to file a federal partnership return

income tax return and showing the partner's

(Form 1065 or Form 1065-B) and it carries on

Apportionment and allocation

distributive share of North Dakota income or

business, or derives income from sources, in

loss. A nonresident individual must file

of income or loss by

North Dakota.

either Form 37-S or Form 37, and a

partnership

Limited liability company (LLC). If an LLC

nonresident estate or trust must file Form 38.

A partnership that carries on its business

is treated like a partnership for federal income

Corporation, partnership or limited

entirely within North Dakota must report all

tax purposes, it is a partnership for North

liability company (LLC). A corporation,

of its income or loss to North Dakota.

Dakota income tax purposes.

partnership or LLC must file a North Dakota

A partnership that carries on its business both

Financial institution. If a partnership meets

income tax return if it derives income from a

inside and outside North Dakota must

the definition of a financial institution under

partnership which does business, or derives

apportion and allocate its income or loss to

N.D.C.C. ch. 57-35.3, it must file North

income from sources, in North Dakota. The

North Dakota in a manner similar to a

Dakota Form 35, Financial Institution Tax

partnership must provide its corporation,

multistate corporation under the provisions of

Return. In this case, Form 58 must not be

partnership and LLC partners with a

N.D.C.C. ch. 57-38.1 (Uniform Division of

used.

statement informing them about the

Income Tax Act).

requirement to file a North Dakota income

Signature. Form 58 must be signed by a

tax return. Special rules apply for

Exception to apportionment/allocation

general partner (or LLC member, if

determining the amount of income or loss

calculations. If all of its partners are resident

applicable) or an authorized representative.

taxable by North Dakota in the case of a

individuals, estates and trusts, a multistate

corporation, partnership or LLC partner. A

Nonfiler penalty. If a partnership fails to file

partnership does not have to apply the

regular corporation must file Form 40 and an

after notice to file is given by the Tax

apportionment and allocation provisions in

S corporation must file Form 60. A

Commissioner, a minimum penalty of $500

completing Form 58. This is because

partnership must file Form 58. The type of

may be assessed.

individual, estate and trust partners must

return, if any, that must be filed by an LLC

report to North Dakota their entire

depends on its entity classification for federal

When and where to file

distributive share of the partnership's federal

income tax purposes.

Form 58 must be filed on or before the 15th

income or loss, regardless of where the

day of the 4th month following the close of

partnership carries on its business.

Composite return

the taxable year. Mail the return to: Office of

A composite filing method is allowed as an

State Tax Commissioner, State Capitol, 600

Reporting of income or loss

alternative method of filing for nonresident

E. Blvd. Ave., Bismarck, ND 58505-0599.

by partners

individual partners. Under this method, one

individual income tax return, referred to as a

A partnership is not subject to North Dakota

Information at the source

"composite return," may be filed by the

income tax. Its income or loss is passed

returns

partnership on behalf of two or more eligible

through to its partners. The amount of

partners. For details, obtain the Income Tax

Every partnership doing business in North

income or loss to report and the forms and

Guideline: Composite Filing Method.

Dakota which is required to file Federal Form

procedures that apply depend on the type of

1099 or W-2 must also file one with the

partner, as explained below.

Assistance

Office of State Tax Commissioner. For more

Resident individual, estate or trust. A

information, obtain the Income Tax

For forms or assistance, call (701)328-3450

resident individual, estate or trust must report

Guideline: Information At The Source Return

or (toll free within North Dakota)

to North Dakota its entire distributive share of

Requirements And Procedures.

1-800-638-2901. Speech or hearing impaired

the partnership's income, gains, and losses, as

persons may call us through Relay North

determined for federal income tax purposes.

Tax incentives for investment

Dakota at 1-800-366-6888 (ask for

This applies even though the partnership is

in certain businesses

1-800-638-2901).

required to apportion and allocate its income

If a partnership invests in a North Dakota

or loss to North Dakota. The partnership is

Persons having Internet access may obtain

venture capital corporation under N.D.C.C.

not required to provide any statement or other

forms, submit questions or comments, and

ch. 10-30.1, the North Dakota Small Business

information to a resident individual, estate or

find other information at:

Investment Company under N.D.C.C.

trust partner.

ch.10-30.2, a North Dakota certified

Nonresident individual, estate or trust. A

Or write to:

nonprofit development corporation under

nonresident individual, estate or trust must

Office of State Tax Commissioner

N.D.C.C. § 10-33-124, or a qualified business

report to North Dakota only its distributive

State Capitol

under N.D.C.C. ch. 57-38.5 (seed capital

share of the partnership's North Dakota

600 E. Boulevard Ave.

investment credit), the partners may be

income or loss, as determined and reported on

Bismarck, ND 58505-0599

entitled to an income tax credit. A deduction

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2