Instructions For Form Tc 109 - Application For Correction Of Assessed Value Of Condominium Property

ADVERTISEMENT

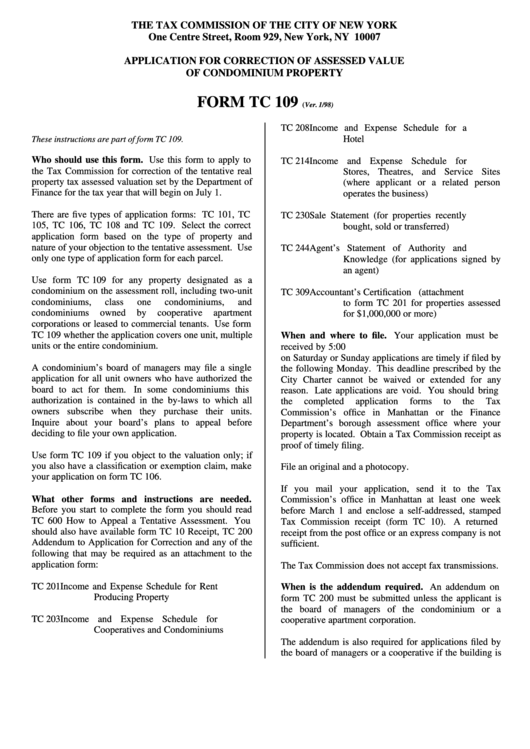

THE TAX COMMISSION OF THE CITY OF NEW YORK

One Centre Street, Room 929, New York, NY 10007

APPLICATION FOR CORRECTION OF ASSESSED VALUE

OF CONDOMINIUM PROPERTY

FORM TC 109

(Ver. 1/98)

TC 208

Income and Expense Schedule for a

Hotel

These instructions are part of form TC 109.

Who should use this form. Use this form to apply to

TC 214

Income and Expense Schedule for

the Tax Commission for correction of the tentative real

Stores, Theatres, and Service Sites

property tax assessed valuation set by the Department of

(where applicant or a related person

Finance for the tax year that will begin on July 1.

operates the business)

There are five types of application forms: TC 101, TC

TC 230

Sale Statement (for properties recently

105, TC 106, TC 108 and TC 109. Select the correct

bought, sold or transferred)

application form based on the type of property and

nature of your objection to the tentative assessment. Use

TC 244

Agent’s Statement of Authority and

only one type of application form for each parcel.

Knowledge (for applications signed by

an agent)

Use form TC 109 for any property designated as a

condominium on the assessment roll, including two-unit

TC 309

Accountant’s Certification (attachment

condominiums,

class

one

condominiums,

and

to form TC 201 for properties assessed

condominiums

owned

by

cooperative

apartment

for $1,000,000 or more)

corporations or leased to commercial tenants. Use form

TC 109 whether the application covers one unit, multiple

When and where to file. Your application must be

units or the entire condominium.

received by 5:00 p.m. on March 1. When March 1 falls

on Saturday or Sunday applications are timely if filed by

A condominium’s board of managers may file a single

the following Monday. This deadline prescribed by the

application for all unit owners who have authorized the

City Charter cannot be waived or extended for any

board to act for them.

In some condominiums this

reason. Late applications are void. You should bring

authorization is contained in the by-laws to which all

the

completed

application

forms

to

the

Tax

owners subscribe when they purchase their units.

Commission’s office in Manhattan or the Finance

Inquire about your board’s plans to appeal before

Department’s borough assessment office where your

deciding to file your own application.

property is located. Obtain a Tax Commission receipt as

proof of timely filing.

Use form TC 109 if you object to the valuation only; if

you also have a classification or exemption claim, make

File an original and a photocopy.

your application on form TC 106.

If you mail your application, send it to the Tax

What other forms and instructions are needed.

Commission’s office in Manhattan at least one week

Before you start to complete the form you should read

before March 1 and enclose a self-addressed, stamped

TC 600 How to Appeal a Tentative Assessment. You

Tax Commission receipt (form TC 10).

A returned

should also have available form TC 10 Receipt, TC 200

receipt from the post office or an express company is not

Addendum to Application for Correction and any of the

sufficient.

following that may be required as an attachment to the

application form:

The Tax Commission does not accept fax transmissions.

TC 201

Income and Expense Schedule for Rent

When is the addendum required. An addendum on

Producing Property

form TC 200 must be submitted unless the applicant is

the board of managers of the condominium or a

TC 203

Income and Expense Schedule for

cooperative apartment corporation.

Cooperatives and Condominiums

The addendum is also required for applications filed by

the board of managers or a cooperative if the building is

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2