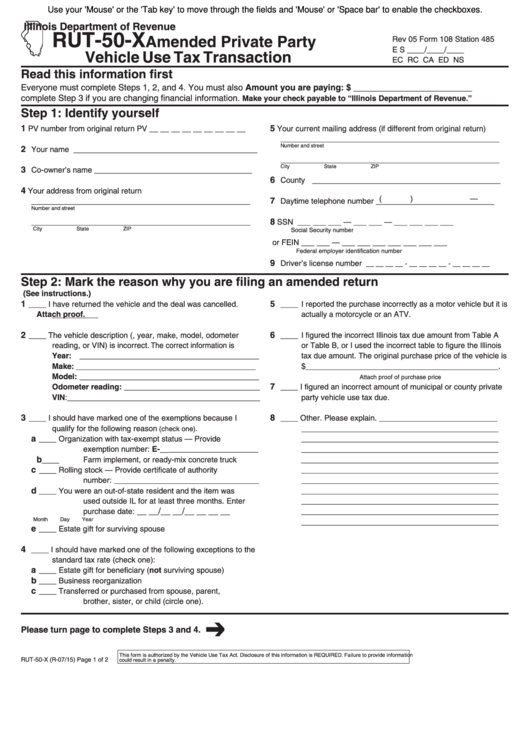

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

RUT-50-X

Amended Private Party

Rev 05 Form 108 Station 485

E S ____/____/____

Vehicle Use Tax Transaction

EC RC CA ED NS

Read this information first

Amount you are paying: $ _________________________

Everyone must complete Steps 1, 2, and 4. You must also

complete Step 3 if you are changing financial information.

Make your check payable to “Illinois Department of Revenue.”

Step 1: Identify yourself

1

5

PV number from original return

PV __ __ __ __ __ __ __ __ __

Your current mailing address (if different from original return)

__________________________________________________

Number and street

2

Your name

__________________________________________

__________________________________________________

City

State

ZIP

3

Co-owner’s name

____________________________________

6

County ___________________________________________

4

Your address from original return

(

)

—

7

Daytime telephone number ___________________________

__________________________________________________

Number and street

8

__________________________________________________

SSN

___ ___ ___ — ___ ___ — ___ ___ ___ ___

City

State

ZIP

Social Security number

or FEIN ___ ___ — ___ ___ ___ ___ ___ ___ ___

Federal employer identification number

9

Driver’s license number

__ __ __ __ - __ __ __ __ - __ __ __ __

Step 2: Mark the reason why you are filing an amended return

(See instructions.)

1

5

____ I have returned the vehicle and the deal was cancelled.

____ I reported the purchase incorrectly as a motor vehicle but it is

Attach proof.

actually a motorcycle or an ATV.

2

6

____ The vehicle description (i.e., year, make, model, odometer

____ I figured the incorrect Illinois tax due amount from Table A

reading, or VIN) is incorrect. The correct information is

or Table B, or I used the incorrect table to figure the Illinois

Year: _________________________________________

tax due amount. The original purchase price of the vehicle is

Make: _________________________________________

$____________________________________________.

Model: _________________________________________

Attach proof of purchase price

7

Odometer reading: _______________________________

____ I figured an incorrect amount of municipal or county private

VIN: ____________________________________________

party vehicle use tax due.

3

8

____ I should have marked one of the exemptions because I

____ Other. Please explain. ___________________________

qualify for the following reason

_____________________________________________

(check one).

a

____ Organization with tax-exempt status — Provide

_____________________________________________

exemption number: E-__

_____________________________________________

_______________________

b

____ Farm implement, or ready-mix concrete truck

_____________________________________________

c

____ Rolling stock — Provide certificate of authority

_____________________________________________

number: _________________________________

_____________________________________________

d

____ You were an out-of-state resident and the item was

_____________________________________________

used outside IL for at least three months. Enter

_____________________________________________

__ __/__ __/__ __ __ __

purchase date:

_____________________________________________

Month

Day

Year

_____________________________________________

e

____ Estate gift for surviving spouse

4

____ I should have marked one of the following exceptions to the

standard tax rate (check one):

a

____ Estate gift for beneficiary (not surviving spouse)

b

____ Business reorganization

c

____ Transferred or purchased from spouse, parent,

brother, sister, or child (circle one).

Please turn page to complete Steps 3 and 4.

This form is authorized by the Vehicle Use Tax Act. Disclosure of this information is REQUIRED. Failure to provide information

RUT-50-X (R-07/15)

Page 1 of 2

could result in a penalty.

1

1 2

2