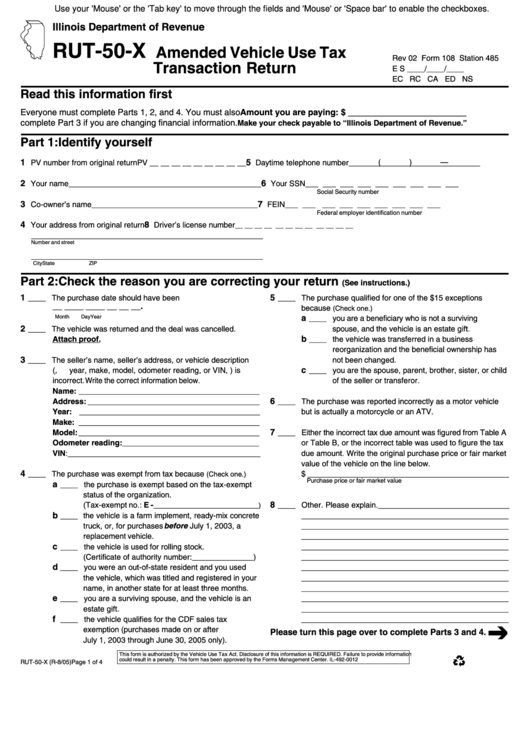

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

RUT-50-X

Amended Vehicle Use Tax

Rev 02 Form 108 Station 485

Transaction Return

E S ____/____/____

EC RC CA ED NS

Read this information first

Everyone must complete Parts 1, 2, and 4. You must also

Amount you are paying: $ _________________________

complete Part 3 if you are changing financial information.

Make your check payable to “Illinois Department of Revenue.”

Part 1: Identify yourself

1

5

(

)

—

PV number from original return

PV __ __ __ __ __ __ __ __ __

Daytime telephone number ______________________________

2

6

Your name ____________________________________________

Your SSN ___ ___ ___ ___ ___ ___ ___ ___ ___

Social Security number

3

7

Co-owner’s name ______________________________________

FEIN

___ ___ ___ ___ ___ ___ ___ ___ ___

Federal employer identification number

4

8

Your address from original return

Driver’s license number

__ __ __ __ __ __ __ __ __ __ __ __

_____________________________________________________

Number and street

_____________________________________________________

City

State

ZIP

Part 2: Check the reason you are correcting your return

(See instructions.)

1

5

____ The purchase date should have been

____ The purchase qualified for one of the $15 exceptions

__ __ __ __ __ __ __ __.

because

(Check one.)

Month

Day

Year

a

____ you are a beneficiary who is not a surviving

2

____ The vehicle was returned and the deal was cancelled.

spouse, and the vehicle is an estate gift.

b

Attach proof.

____ the vehicle was transferred in a business

reorganization and the beneficial ownership has

3

____ The seller’s name, seller’s address, or vehicle description

not been changed.

c

( i.e., year, make, model, odometer reading, or VIN, ) is

____ you are the spouse, parent, brother, sister, or child

incorrect. Write the correct information below.

of the seller or transferor.

Name: _________________________________________

6

Address: _______________________________________

____ The purchase was reported incorrectly as a motor vehicle

Year: _________________________________________

but is actually a motorcycle or an ATV.

Make: _________________________________________

7

Model: _________________________________________

____ Either the incorrect tax due amount was figured from Table A

Odometer reading:_______________________________

or Table B, or the incorrect table was used to figure the tax

VIN:____________________________________________

due amount. Write the original purchase price or fair market

value of the vehicle on the line below.

4

____ The purchase was exempt from tax because

$ ______________________________________________

(Check one.)

Purchase price or fair market value

a

____ the purchase is exempt based on the tax-exempt

status of the organization.

8

(Tax-exempt no.: E -

____ Other. Please explain.______________________________

___________________________)

b

____ the vehicle is a farm implement, ready-mix concrete

_______________________________________________

truck, or, for purchases before July 1, 2003, a

_______________________________________________

replacement vehicle.

_______________________________________________

c

____ the vehicle is used for rolling stock.

_______________________________________________

(Certificate of authority number: ______________)

_______________________________________________

d

____ you were an out-of-state resident and you used

_______________________________________________

the vehicle, which was titled and registered in your

_______________________________________________

name, in another state for at least three months.

_______________________________________________

e

____ you are a surviving spouse, and the vehicle is an

_______________________________________________

estate gift.

_______________________________________________

f

____ the vehicle qualifies for the CDF sales tax

_______________________________________________

exemption (purchases made on or after

Please turn this page over to complete Parts 3 and 4.

July 1, 2003 through June 30, 2005 only).

This form is authorized by the Vehicle Use Tax Act. Disclosure of this information is REQUIRED. Failure to provide information

could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0012

RUT-50-X (R-8/05)

Page 1 of 4

1

1 2

2