Rut-50 Private Party Vehicle Use Tax Chart For 2017 - Illinois Department Of Revenue

ADVERTISEMENT

Illinois Department of Revenue

RUT-50 Private Party

Vehicle Use Tax Chart for 2017

Effective January 1, 2017, through December 31, 2017

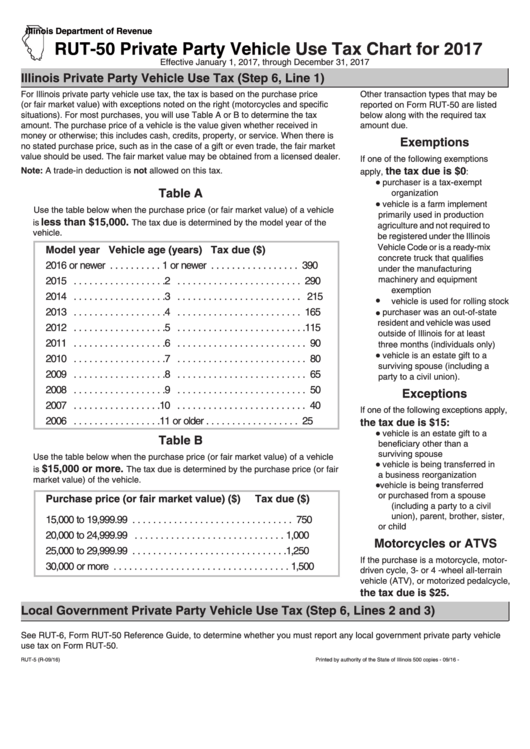

Illinois Private Party Vehicle Use Tax (Step 6, Line 1)

For Illinois private party vehicle use tax, the tax is based on the purchase price

Other transaction types that may be

(or fair market value) with exceptions noted on the right (motorcycles and specific

reported on Form RUT-50 are listed

situations). For most purchases, you will use Table A or B to determine the tax

below along with the required tax

amount. The purchase price of a vehicle is the value given whether received in

amount due.

money or otherwise; this includes cash, credits, property, or service. When there is

Exemptions

no stated purchase price, such as in the case of a gift or even trade, the fair market

value should be used. The fair market value may be obtained from a licensed dealer.

If one of the following exemptions

the tax due is $0

Note: A trade-in deduction is not allowed on this tax

.

apply,

:

•

purchaser is a tax-exempt

Table A

organization

•

vehicle is a farm implement

Use the table below when the purchase price (or fair market value) of a vehicle

primarily used in production

less than $15,000.

is

The tax due is determined by the model year of the

agriculture and not required to

vehicle.

be registered under the Illinois

Vehicle Code or is a ready-mix

Model year

Vehicle age (years)

Tax due ($)

concrete truck that qualifies

2016 or newer . . . . . . . . . . 1 or newer . . . . . . . . . . . . . . . . . 390

under the manufacturing

machinery and equipment

2015 . . . . . . . . . . . . . . . . . .2 . . . . . . . . . . . . . . . . . . . . . . . . 290

exemption

2014 . . . . . . . . . . . . . . . . . .3 . . . . . . . . . . . . . . . . . . . . . . . . 215

•

vehicle is used for rolling stock

2013 . . . . . . . . . . . . . . . . . .4 . . . . . . . . . . . . . . . . . . . . . . . . 165

•

purchaser was an out-of-state

resident and vehicle was used

2012 . . . . . . . . . . . . . . . . . .5 . . . . . . . . . . . . . . . . . . . . . . . . .115

outside of Illinois for at least

2011 . . . . . . . . . . . . . . . . . .6 . . . . . . . . . . . . . . . . . . . . . . . . . 90

three months (individuals only)

•

vehicle is an estate gift to a

2010 . . . . . . . . . . . . . . . . . .7 . . . . . . . . . . . . . . . . . . . . . . . . . 80

surviving spouse (including a

2009 . . . . . . . . . . . . . . . . . .8 . . . . . . . . . . . . . . . . . . . . . . . . . 65

party to a civil union).

2008 . . . . . . . . . . . . . . . . . .9 . . . . . . . . . . . . . . . . . . . . . . . . . 50

Exceptions

2007 . . . . . . . . . . . . . . . . .10 . . . . . . . . . . . . . . . . . . . . . . . . . 40

If one of the following exceptions apply,

2006 . . . . . . . . . . . . . . . . .11 or older . . . . . . . . . . . . . . . . . . 25

the tax due is $15:

•

vehicle is an estate gift to a

Table B

beneficiary other than a

surviving spouse

Use the table below when the purchase price (or fair market value) of a vehicle

•

vehicle is being transferred in

$15,000 or more.

is

The tax due is determined by the purchase price (or fair

a business reorganization

market value) of the vehicle.

•

vehicle is being transferred

or purchased from a spouse

Purchase price (or fair market value) ($)

Tax due ($)

(including a party to a civil

union), parent, brother, sister,

15,000 to 19,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 750

or child

20,000 to 24,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000

Motorcycles or ATVS

25,000 to 29,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1,250

If the purchase is a motorcycle, motor-

30,000 or more . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500

driven cycle, 3- or 4 -wheel all-terrain

vehicle (ATV), or motorized pedalcycle,

the tax due is $25.

Local Government Private Party Vehicle Use Tax (Step 6, Lines 2 and 3)

See RUT-6, Form RUT-50 Reference Guide, to determine whether you must report any local government private party vehicle

use tax on Form RUT-50.

RUT-5 (R-09/16)

Printed by authority of the State of Illinois 500 copies - 09/16 - P.O. Number 2170029

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1