Form Rut-50-X - Amended Vehicle Use Tax Transaction Return 1998

ADVERTISEMENT

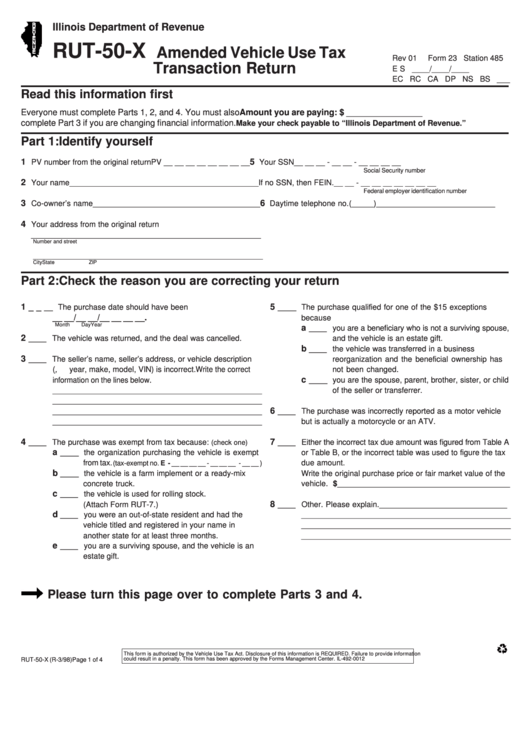

Illinois Department of Revenue

RUT-50-X

Amended Vehicle Use Tax

Rev 01

Form 23

Station 485

Transaction Return

E S ____/____/____

EC RC CA DP NS BS ___

Read this information first

Everyone must complete Parts 1, 2, and 4. You must also

Amount you are paying: $ ________________

complete Part 3 if you are changing financial information.

Make your check payable to “Illinois Department of Revenue.”

Part 1: Identify yourself

1

5

PV number from the original return

PV __ __ __ __ __ __ __ __

Your SSN

__ __ __ - __ __ - __ __ __ __

Social Security number

2

Your name ___________________________________________

If no SSN, then FEIN.

__ __ - __ __ __ __ __ __ __

Federal employer identification number

3

6

Co-owner’s name ______________________________________

Daytime telephone no. (_____)___________________________

4

Your address from the original return

____________________________________________________

Number and street

____________________________________________________

City

State

ZIP

Part 2: Check the reason you are correcting your return

1 __

5

__ The purchase date should have been

____ The purchase qualified for one of the $15 exceptions

__ __/__ __/__ __ __ __.

because

Month

Day

Year

a

____ you are a beneficiary who is not a surviving spouse,

2

____ The vehicle was returned, and the deal was cancelled.

and the vehicle is an estate gift.

b

____ the vehicle was transferred in a business

3

____ The seller’s name, seller’s address, or vehicle description

reorganization and the beneficial ownership has

( i.e., year, make, model, VIN) is incorrect. Write the correct

not been changed.

c

information on the lines below.

____ you are the spouse, parent, brother, sister, or child

_______________________________________________

of the seller or transferrer.

_______________________________________________

6

_______________________________________________

____ The purchase was incorrectly reported as a motor vehicle

_______________________________________________

but is actually a motorcycle or an ATV.

4

7

____ The purchase was exempt from tax because:

____ Either the incorrect tax due amount was figured from Table A

(check one)

a

____ the organization purchasing the vehicle is exempt

or Table B, or the incorrect table was used to figure the tax

from tax.

due amount.

(tax-exempt no. E - __ __ __ __ - __ __ __ - __ __ )

b

____ the vehicle is a farm implement or a ready-mix

Write the original purchase price or fair market value of the

concrete truck.

vehicle. $_______________________________________

c

____ the vehicle is used for rolling stock.

8

(Attach Form RUT-7.)

____ Other. Please explain. _____________________________

d

____ you were an out-of-state resident and had the

_______________________________________________

vehicle titled and registered in your name in

_______________________________________________

another state for at least three months.

_______________________________________________

e

____ you are a surviving spouse, and the vehicle is an

estate gift.

Please turn this page over to complete Parts 3 and 4.

This form is authorized by the Vehicle Use Tax Act. Disclosure of this information is REQUIRED. Failure to provide information

could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0012

RUT-50-X (R-3/98)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2