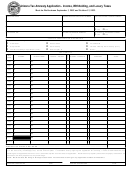

Nebraska Tax Amnesty Application Page 2

Download a blank fillable Nebraska Tax Amnesty Application in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Nebraska Tax Amnesty Application with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

PART III — PARTICIPATION REQUIREMENTS

All participants must submit and sign a Nebraska Tax Amnesty Application to participate in the Tax Amnesty Program.

All amnesty applications must be postmarked by November 1, 2004.

Full payment of all tax due for the tax(es) indicated in Part II must be made by December 31, 2004, or the full amount of

interest and penalties will apply.

If you are amending tax returns previously filed, full payment is due within 30 days from the approved application date.

By signing the application, the participant agrees to pay all the amounts due, and waives all rights to request a refund for

any amount paid as part of the Tax Amnesty Program.

A participant that has not filed tax returns or reported the proper amount of tax for the amnesty-eligible tax periods (tax

periods due on or before April 1, 2004) may submit actual or corrected returns.

Tax payments received without a completed application will be applied to existing liabilities, if any.

The Nebraska Department of Revenue reserves the right to adjust the amount of tax due at a future date as a result of state

or federal audit.

Person to Contact Regarding This Application

Title

Daytime Telephone Number

Method of Payment You Plan to Use

Check/Money Order

Credit Card

Electronic Funds Transfer

Under penalties of law, I declare that, as taxpayer or preparer, I have examined this application, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Taxpayer Signature (primary taxpayer if Individual; Owner, Partner, Corporate

Signature of Preparer Other Than Taxpayer

Officer, or other person authorized by attached Power of Attorney)

Spouse's Signature, if Individual; or Title, if Business

Date

Address

Date

PART IV — FOR DEPARTMENT OF REVENUE USE ONLY

APPROVED

COMMENTS:

DENIED (see comments)

PARTIALLY APPROVED (see comments)

Your return(s) and payment(s)

are due on or before:

Authorized Signature

Approval Date

FOR NEBRASKA TAX ASSISTANCE

1-800-742-7474

1-402-471-5729

Contact your regional office or call

(toll free in NE and IA) or

E-mail inquiries regarding Nebraska Tax Amnesty can be sent to: amnesty@rev.state.ne.us

Nebraska Department of Revenue Amnesty Web site address:

A copy of the Taxpayer Bill of Rights is available by calling any of our regional offices or visiting our Web site.

GRAND ISLAND

SCOTTSBLUFF

OMAHA

TierOne Bank Building, Suite 460

Nebraska State Office Building

Panhandle State Office Complex

4500 Avenue I, Box 1500

1811 West Second Street

1313 Farnam-on-the-Mall

Grand Island, Nebraska 68803-5469

Omaha, Nebraska 68102-1871

Scottsbluff, Nebraska 69363-1500

Telephone (308) 385-6067

Telephone (402) 595-2065

Telephone (308) 632-1200

NORTH PLATTE

NORFOLK

LINCOLN

Craft State Office Building

304 North 5th Street, Suite “D”

Nebraska State Office Building

200 South Silber Street

Norfolk, Nebraska 68701-4091

301 Centennial Mall South

Telephone (402) 370-3333

North Platte, Nebraska 69101-4200

Lincoln, Nebraska 68509-4818

Telephone (308) 535-8250

Telephone (402) 471-5729

For Motor Fuels tax programs only, call toll free 1-800-554-3835 (Lincoln residents call 471-5730).

For Charitable Gaming programs only, call toll free 1-877-564-1315 (Lincoln residents call 471-5937).

Hearing-impaired individuals may call the Text Telephone (TT) at 1-800-382-9309. TDD (Telecommunications Device for the Deaf) is designated by the use

of “TT,” which is consistent with the Americans with Disabilities Act.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2