Maine Tax Amnesty Application Form - September 1 - November 30, 2003

ADVERTISEMENT

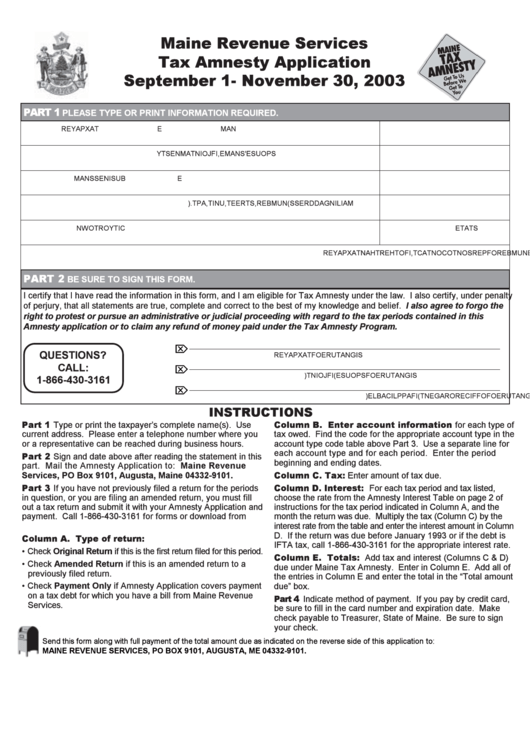

Maine Revenue Services

Tax Amnesty Application

September 1- November 30, 2003

PART 1

PLEASE TYPE OR PRINT INFORMATION REQUIRED.

T

A

X

P

A

Y

E

R

N

A

M

E

S

O

C

A I

L

S

E

C

U

R

T I

Y

N

U

M

B

E

R

S

P

O

U

S

E

S '

N

A

M

, E

F I

J

O

I

N

T

A

M

N

E

S

T

Y

S

O

C

A I

L

S

E

C

U

R

T I

Y

N

U

M

B

E

R

B

U

I S

N

E

S

S

N

A

M

E

A

C

C

O

U

N

T

N

U

M

B

E

R

O

R

E

N I

N

U

M

B

E

R

M

A

L I

N I

G

A

D

D

R

E

S

S

(

N

U

M

B

E

, R

S

T

R

E

E

, T

U

I N

, T

A

P

T

) .

T

E

L

E

P

H

O

N

E

N

U

M

B

E

R

C

T I

Y

O

R

T

O

W

N

S

T

A

T

E

Z

P I

C

O

D

E

N

A

M

E

A

N

D

T

E

L

E

P

H

O

N

E

N

U

M

B

E

R

O

F

P

E

R

S

O

N

T

O

C

O

N

T

A

C

, T

F I

O

T

H

E

R

T

H

A

N

T

A

X

P

A

Y

E

R

PART 2

BE SURE TO SIGN THIS FORM.

I certify that I have read the information in this form, and I am eligible for Tax Amnesty under the law. I also certify, under penalty

of perjury, that all statements are true, complete and correct to the best of my knowledge and belief. I also agree to forgo the

right to protest or pursue an administrative or judicial proceeding with regard to the tax periods contained in this

Amnesty application or to claim any refund of money paid under the Tax Amnesty Program.

Ö

QUESTIONS?

I S

G

N

A

T

U

R

E

O

F

T

A

X

P

A

Y

E

R

D

A

T

E

CALL:

Ö

I S

G

N

A

T

U

R

E

O

F

S

P

O

U

S

E

(

F I

J

O

N I

) T

D

A

T

E

1-866-430-3161

Ö

I S

G

N

A

T

U

R

E

O

F

O

F

F

C I

E

R

O

R

A

G

E

N

T

(

F I

A

P

P

L

C I

A

B

L

) E

D

A

T

E

INSTRUCTIONS

Part 1 Type or print the taxpayer’s complete name(s). Use

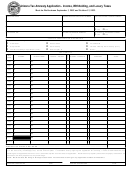

Column B. Enter account information for each type of

current address. Please enter a telephone number where you

tax owed. Find the code for the appropriate account type in the

or a representative can be reached during business hours.

account type code table above Part 3. Use a separate line for

each account type and for each period. Enter the period

Part 2 Sign and date above after reading the statement in this

beginning and ending dates.

part. Mail the Amnesty Application to: Maine Revenue

Services, PO Box 9101, Augusta, Maine 04332-9101.

Column C. Tax: Enter amount of tax due.

Part 3 If you have not previously filed a return for the periods

Column D. Interest: For each tax period and tax listed,

in question, or you are filing an amended return, you must fill

choose the rate from the Amnesty Interest Table on page 2 of

out a tax return and submit it with your Amnesty Application and

instructions for the tax period indicated in Column A, and the

payment. Call 1-866-430-3161 for forms or download from

month the return was due. Multiply the tax (Column C) by the

interest rate from the table and enter the interest amount in Column

D. If the return was due before January 1993 or if the debt is

Column A. Type of return:

IFTA tax, call 1-866-430-3161 for the appropriate interest rate.

• Check Original Return if this is the first return filed for this period.

Column E. Totals: Add tax and interest (Columns C & D)

• Check Amended Return if this is an amended return to a

due under Maine Tax Amnesty. Enter in Column E. Add all of

previously filed return.

the entries in Column E and enter the total in the “Total amount

• Check Payment Only if Amnesty Application covers payment

due” box.

on a tax debt for which you have a bill from Maine Revenue

Part 4 Indicate method of payment. If you pay by credit card,

Services.

be sure to fill in the card number and expiration date. Make

check payable to Treasurer, State of Maine. Be sure to sign

your check.

Send this form along with full payment of the total amount due as indicated on the reverse side of this application to:

MAINE REVENUE SERVICES, PO BOX 9101, AUGUSTA, ME 04332-9101.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2