Form Sc Sch Tc4-Sa - Alternative Small Business Job Tax Credit - State Of South Carolina Department Of Revenue Page 2

ADVERTISEMENT

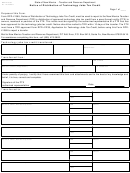

STEP 1, PART B (continued)

NOTE: Round down to the next whole number. Enter -0- if the increase is less than 2. You do not qualify for the credit for that tax year.

YEAR

YEAR

YEAR

YEAR

YEAR

YEAR

1

2

3

4

5

6

LINE 6: YEAR 1 INCREASE

LINE 7: YEAR 2 INCREASE

LINE 8: YEAR 3 INCREASE

LINE 9: YEAR 4 INCREASE

LINE 10: YEAR 5 INCREASE

LINE 11: YEAR 6 INCREASE

LINE 12: JOBS QUALIFYING FOR CREDIT

STEP 2 – QUALIFYING FOR THE 100% CREDIT

PART A - DETERMINING THE 120% THRESHOLDS:

If gross wages, when annualized, are paid at or above 120% of the county or State per capita income, whichever is less, the jobs are

eligible for 100% of the traditional credit amount for each qualifying month. If gross wages, when annualized, are below 120% of both

the county and State per capita income, the jobs are eligible for 50% of the traditional credit amount (prorated) for each qualifying

month. Gross wages are annualized when you multiply them by 12 months and divide them by the actual number of months worked in a

tax year.

Prior year threshold:

1. State’s per capita income at the end of the prior year (see STEP 2 instructions) . . . . . . 1. $

2. County’s per capita income at the end of the prior year (see STEP 2 instructions) . . . . 2. $

3. Lesser of Line 1 or Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $

4. 120% threshold percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

X 4.

120%

5. Multiply Line 3 by Line 4. This is the 120% threshold (Round to nearest whole dollar). .

5. $

If gross wages, when annualized, were paid in the Prior Year at or above the amount on Line 5, include the job in the Prior Year

column below. See intructions for definitions for "annualizing."

Tax year threshold:

6. State's per capita income at the end of the tax year (see STEP 2 instructions) . . . . . . . . 6. $

7. County's per capita income at the end of the tax year (see STEP 2 instructions) . . . . . . 7. $

8. Lesser of Line 6 or Line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. $

9. 120% threshold percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X 9.

120%

10. Multiply Line 8 by Line 9. This is the 120% threshold (Round to nearest whole dollar) . . 10. $

If gross wages, when annualized, were paid during the tax year at or above the amount on Line 10, include the job in appropriate

column below. See intructions for definitions for "annualizing."

34492017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4