Form Sc Sch Tc4-Sa - Alternative Small Business Job Tax Credit - State Of South Carolina Department Of Revenue Page 3

ADVERTISEMENT

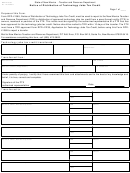

STEP 2 (continued), PART B - COMPUTING JOBS OVER THE 120% THRESHOLDS:

FULL TIME EMPLOYEES OVER THE 120% THRESHOLD IN EACH MONTH (Enter 0.5 for each qualifying part time job)

PRIOR

YEAR

YEAR

YEAR

YEAR

YEAR

YEAR

YEAR

1

2

3

4

5

6

MONTH

1

2

3

4

5

6

7

8

9

10

11

12

COMPUTATION OF JOBS OVER THE 120% THRESHOLD

LINE 1: TOTAL EMPLOYEES

OVER THE 120%

THRESHOLD

LINE 2: DIVIDED BY: NUMBER OF

MONTHS IN OPERATION

LINE 3: MONTHLY AVERAGE OF

EMPLOYEES OVER THE

THRESHOLD

NOTE: Round down to the next whole number. Enter -0- if the increase is less than 2. You do not qualify for the 100% credit

for that tax year.

LINE 4: LESS: PREVIOUS YEAR

AVERAGE

(line 3 of previous column)

LINE 5: AVERAGE INCREASE IN

EMPLOYEES OVER THE

THRESHOLD

LINE 6: YEAR 1 INCREASE

LINE 7: YEAR 2 INCREASE

LINE 8: YEAR 3 INCREASE

LINE 9: YEAR 4 INCREASE

LINE 10: YEAR 5 INCREASE

LINE 11: YEAR 6 INCREASE

LINE 12: JOBS QUALIFYING FOR 100%

CREDIT (add lines 6 through 11)

34493015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4