Form Sc Sch Tc4-Sa - Alternative Small Business Job Tax Credit - State Of South Carolina Department Of Revenue Page 4

ADVERTISEMENT

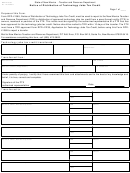

STEP 3 – DETERMINING THE ALLOWABLE CREDIT

100% Allowable Credit

Line 1

100% credit amount for each job (see STEP 3 instructions) . . . . . . . . . . . . . . . . . . . . . .

1. $_______________

Line 2

Additional credit amount(s) (see STEP 3 instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

2. $_______________

Line 3

Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. $_______________

Line 4

Enter the amount from STEP 2, PART B, line 12 for the appropriate tax year . . . . . . . .

4. _______________

Line 5

Allowable 100% credit. Multiply line 3 by line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. $_______________

50% Allowable Credit

Line 6.

50% credit amount for each job (see STEP 3 instructions) . . . . . . . . . . . . . . . . . . . . . . .

6. $_______________

Line 7.

Additional credit amount(s) (see STEP 3 instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

7 $_______________

Line 8

Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. $_______________

Line 9

Enter the amount from STEP 1, PART B, line 12 for the appropriate tax year . . . . . . . .

9. _______________

Line 10

Line 9 minus line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. _______________

Line 11

Allowable 50% credit. Multiply line 8 by Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. $_______________

Total Allowable Credit

Line 12

Add lines 5 and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12. $_______________

Line 13

Your carryover credit from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. $_______________

Line 14

Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. $_______________

Line 15

Your current tax year tax liability. (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . 15. $_______________

Line 16

Multiply line 15 by 50% (0.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16. $_______________

Line 17

Enter the smaller of line 14 or line 16. Enter this amount on the appropriate tax credit

schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. $_______________

Line 18 Line 14 minus line 17. Unused credits may be carried forward for 15 years . . . . . . . . . . . . 18. $_______________

34494013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4