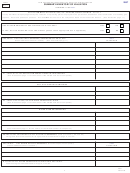

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

2007

SUMMARY INVENTORY OF VALUATION

MS-1

INSTRUCTIONS

Instructions

Enter the following: name of the City/Town, County, Officials, date, telephone number of the City/Town, whether a governing body or

PAGE 1

assessor, contact person for questions on this form, e-mail address and the regular office hours. Signatures should be printed and

signed in ink.

LAND VALUES ONLY - Exclude amount listed on Lines 3A, 3B and 4.

PAGE 2

LINE 1A Enter the total number of acres and total assessed valuation (at current use values), from page 6 of Current Use Report.

LINE 1B Enter total number of acres and total assessed valuation (at current use values), from page 6 of Conservation Restriction

Assessment Report.

LINE 1C Enter the total number of acres and total assessed valuation from page 6 of the Discretionary Easements section.

LINE 1D Enter the total number of acres and total assessed valuation from page 7 of the Discretionary Preservation Easement

section.

LINE 1E

Enter the total number of acres and total assessed valuation for residential land (improved and unimproved).

LINE 1F

Enter the total number of acres and total assessed valuation for commercial/industrial land (Do Not Include Utility Land).

LINE 1G Enter the total taxable land, Lines 1A through 1F.

LINE 1H Enter the total number of acres and total assessed valuation for tax-exempt and non-taxable land. These figures are

captured for tracking purposes only.

BUILDING VALUES ONLY - Exclude amounts listed on Lines 3A and 3B.

LINE 2A Enter the total assessed residential building values.

LINE 2B Enter the total assessed manufactured housing values (Trailers on Wheels only).

LINE 2C Enter the total assessed commercial/industrial building values (Do Not Include Utility Buildings).

LINE 2D Enter the total number of structures for discretionary preservation easement buildings and total assessed valuation from

page 7 of Discretionary Preservation Easement section.

LINE 2E

Enter the Total of taxable buildings, Lines 2A through 2D,.

LINE 2F

Enter the total assessed valuation for tax-exempt and non-taxable buildings. These figures are captured for tracking

purposes only.

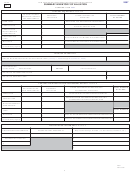

UTILITIES

LINE 3A Enter the total assessed valuation of all “A” Utilities from page 4, the grand total valuation of all ”A” Utility Companies

(these are Utilities the Department of Revenue Administration sends a tax bill to for the state-wide property tax). For

further clarification, please call the Utility Appraiser at (603) 271-2687.

LINE 3B Enter the total assessed valuation of all “B” Utilities from page 4, the total of section “B”. Please make sure this is NOT an

“A” Utility or a Pilot agreement. For further clarification, please call the Utility Appraiser at (603) 271-2687.

OTHER

LINE 4

Enter the total assessed valuation of mature wood and timber.

LINE 5

Enter the total of Lines 1G, 2E, 3A, 3B and 4. This figure represents the gross sum of all taxable property in your

municipality.

LINE 6

Enter the total number granted and the total assessed valuation of Certain Disabled Veterans (RSA 72:36-a). If the

assessed value is NOT included in the totals of 1G or 2E, do not include a value on this line.

LINE 7

Enter the total number granted and the total assessed valuation for Improvements to Assist the Deaf (RSA 72:38-b).

LINE 8

Enter the total granted and the total assessed valuation for Improvements to Assist Person with Disabilities (RSA 72:37-a).

LINE 9

Enter the total granted and the total assessed valuation for School Dining/Dormitory/Kitchen Exemption (RSA 72-23 IV).

The standard exemption is up to $150,000 for each one granted. Anything over $150,000 must be voted in at town meeting.

LINE 10

Enter the total number granted and the total assessed valuation for Water/Air Pollution Control Exemptions (RSA 72:12-a).

These amounts are determined by the Department of Environmental Services.

LINE 11

Enter the total of Line 5 minus Lines 6,7,8,9 and 10. This figure will be used for calculating the total equalized value for

your municipality.

LINE 12

Enter the total number granted, the amount granted per exemption and the total assessed valuation for the Blind

Exemption (RSA 72:37).

LINE 13

Enter the total number granted and the total assessed valuation for the Elderly Exemption (RSA 72:39-a & b).

LINE 14

Enter the number granted, amount granted per exemption and the total assessed valuation for the Deaf Exemption (RSA

72:38-b).

LINE 15

Enter the total number granted, the amount granted per exemption and the total assessed valuation for the Disabled

Exemption (RSA 72:37-b).

LINE 16 Enter the total number granted and the total assessed valuation for the Wood-Heating Energy Systems Exemption

PAGE 3

(RSA 72:70).

LINE 17

Enter the total number granted and the total assessed valuation for the Solar Energy Exemption (RSA 72:62).

LINE 18

Enter the number granted and the total assessed valuation for the Wind Powered Energy Systems Exemption (RSA 72:66).

LINE 19

Enter the total number granted and the total assessed valuation for Additional School Dining/Dormitory/Kitchen Exemption

(RSA 72:23 IV). Amounts in excess of $150,000 only.

LINE 20

Enter the total of Line 12 through Line 19.

LINE 21

Enter the net valuation on which the tax rate for municipal, county and local education tax is computed. Line 11 minus Line 20.

LINE 22

Enter the Utilities, Line 3A carried forward. DO NOT include the value of Other Utilities listed on Line 3B.

LINE 23

Enter Line 21 minus Line 22. The Net Valuation without Utilities on which the tax rate for State Education Tax is computed.

MS-1

Instructions

Rev. 7/17/07

10

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15