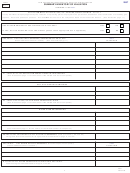

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

2007

SUMMARY INVENTORY OF VALUATION

MS-1

INSTRUCTIONS

Instructions

See the following scenarios to determine which amounts will be used for equalization and for setting tax rates.

SCENARIO 1 - ALL RETAINED

All retained for bond/operations and development RSA 162-K:10, III (a)(1)

Equalization = Current Assessed Value Used ($100,000)

Current Assessed Value

$100,000

Original Assessed Value

($ 40,000)

Captured Assessed Value

$ 60,000

Tax Rate (page 2) = Current Assessed Value less Full Retained Captured

Captured Assessed Value

$ 60,000

Retained to Pay Bonds

($ 30,000)

Assessed Value ($100,000 - $60,000). (Assessors apply rate to current

assessed value $100,000).

Retained for Operations & Maintenance

($ 30,000)

Unretained (shared)

$

0

SCENARIO 2 - SOME UNRETAINED

Some not retained for bond/operations and development RSA 162-K:10, III (a)(2)

Current Assessed Value

$100,000

Equalization = Current Assessed Value Used ($100,000)

Original Assessed Value

($ 40,000)

Captured Assessed Value

$ 60,000

Tax Rate (page 2) = Current Assessed Value less Retained Captured

Capture Assessed Value

$ 60,000

Assessed Value ($100,000 - $50,000). (Assessors apply rate to current

Retained to Pay Bonds

($ 30,000)

assessed value $100,000).

Retained for Operations & Maintenance

($ 20,000)

Unretained (shared)

$ 10,000

SCENARIO 3 - GRANDFATHERED (prior to 4/29/99) ALL RETAINED

All retained for bond/operations and development RSA 162-K:10, III (b)(1)

Equalization = Original Assessed Value ($40,000, same as tax rate)

Current Assessed Value

$100,000

Original Assessed Value

($ 40,000)

Captured Assessed Value

$ 60,000

Tax Rate (page 2) = Original Assessed Value ($40,000 and then apply tax

Capture Assessed Value

$ 60,000

Retained to Pay Bonds

($ 30,000)

rates to higher current assessed value of $100,000)

Retained for Operations & Maintenance

($ 30,000)

Unretained (shared)

$

0

SCENARIO 4 - GRANDFATHERED (prior to 4/29/99) SOME UNRETAINED

Some not retained for bond/operations and development RSA 162-K:10, III (b)(2)

Equalization = Original Assessed Value plus Unretained Captured

Current Assessed Value

$100,000

Assessed Value ($40,000 + $10,000 and then apply tax rates to the total

Original Assessed Value

($ 40,000)

current assessed value of $100,000).

Captured Assessed Value

$ 60,000

Capture Assessed Value

$ 60,000

Tax Rate (page 2) = Original Assessed Value plus Unretained Captured

Assessed Value ($40,000 + $10,000 and then apply tax rates to the total

Retained to Pay Bonds

($ 30,000)

Retained for Operations & Maintenance

($ 20,000)

current assessed value of $100,000).

Unretained (shared)

$ 10,000

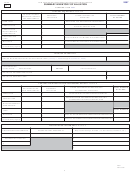

- EXAMPLES -

The amounts shown in bold will be used for equalization purposes.

TIF # 1

TIF # 2

TIF #3

TIF #4

Tax Increment Financing Districts

RSA 162-K

Scenario 1

Scenario 2

Scenario 3

Scenario 4

(Grandfathered)

(Grandfathered)

Date of Adoption

6/1/00

3/15/00

1/13/97

1/30/98

Original Assessed Value

$ 40,000

$ 40,000

$40,000

$40,000

+ Unretained Captured Assessed Value

$ 0

$ 10,000

$ 0

$10,000

= Amount used must be included on page 2 (tax rates)

$ 40,000

$ 50,000

$40,000

$50,000

+ Retained Captured Assessed Value

$ 60,000

$ 50,000

$60,000

$50,000

Current Assessed Value

$100,000

$100,000

$100,000

$100,000

MS-1

Instructions

Rev. 7/17/07

14

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15