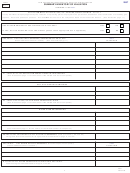

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

2007

FORM

SUMMARY INVENTORY OF VALUATION

MS-1

FORM MS-1 FOR 2007

Lines 1A, B, C, D, E & F List all improved and unimproved land

LAND

2007

ASSESSED VALUATION

NUMBER

(include wells, septic & paving)

By CITY/TOWN

OF ACRES

BUILDINGS

Lines 2 A, B, C and D List all buildings

1

VALUE OF LAND ONLY - Exclude Amount Listed in Lines 3A, 3B and 4

$

A

Current Use (At Current Use Values) RSA 79-A (See page 10)

B

Conservation Restriction Assessment (At Current Use Values) RSA 79-B

$

C

Discretionary Easement RSA 79-C

$

$

D

Discretionary Preservation Easement RSA 79-D

E

Residential Land (Improved and Unimproved Land)

$

F

Commercial/Industrial (DO NOT Include Utility Land)

$

G

Total of Taxable Land (Sum of lines 1A, 1B, 1C, 1D, 1E and 1F)

$

H

Tax Exempt & Non-Taxable Land

($

)

2

VALUE OF BUILDINGS ONLY - Exclude Amounts Listed on Lines 3A and 3B

$

A

Residential

$

Manufactured Housing as defined In RSA 674:31

B

$

C

Commercial/Industrial (DO NOT Include Utility Buildings)

$

Discretionary Preservation Easement RSA 79-D

Number of Structures

D

E

Total of Taxable Buildings (Sum of lines 2A, 2B, 2C and 2D)

$

F

Tax Exempt & Non-Taxable Buildings

($

)

3

UTILITIES (see RSA 83-F:1V for complete definition)

Utilities (Real estate/buildings/structures/machinery/dynamos/apparatus/poles/wires/fixtures of all

$

A

kinds and descriptions/pipelines etc.)

B

$

Other Utilities (Total of Section B From Utility Summary)

4

$

MATURE WOOD AND TIMBER RSA 79:5

VALUATION BEFORE EXEMPTIONS (Total of Lines 1G, 2E, 3A, 3B and 4)

5

$

This figure represents the gross sum of all taxable property in your municipality.

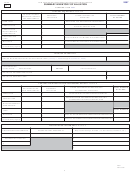

Certain Disabled Veterans RSA 72:36-a (Paraplegic and Double

6

$

Total # granted

Amputees Owning Specially Adapted Homesteads with VA Assistance)

Improvements to Assist the Deaf RSA 72:38-b

Total # granted

$

7

Improvements to Assist Persons with Disabilities

8

Total # granted

$

RSA 72:37-a

School Dining/Dormitory/Kitchen Exemption RSA 72:23 IV

9

Total # granted

$

(Standard Exemption up to $150,000 for each) (See page 10)

10

Total # granted

$

Water/Air Pollution Control Exemptions

RSA 72:12-a

MODIFIED ASSESSED VALUATION OF ALL PROPERTIES (Line 5 minus Lines 6, 7, 8, 9 and 10)

11

$

This figure will be used for calculating the total equalized value for your municipality.

Total # granted

12

Blind Exemption

RSA 72:37

$

Amount granted per exemption

$

13

Elderly Exemption

RSA 72:39-a & b

Total # granted

$

Total # granted

14

Deaf Exemption

RSA 72:38-b

$

Amount granted per exemption

$

Total # granted

15

Disabled Exemption

RSA 72:37-b

$

Amount granted per exemption

$

MS-1

2

Rev. 7/17/07

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15