Instructions For Pa-65 Form - Pennsylvania

ADVERTISEMENT

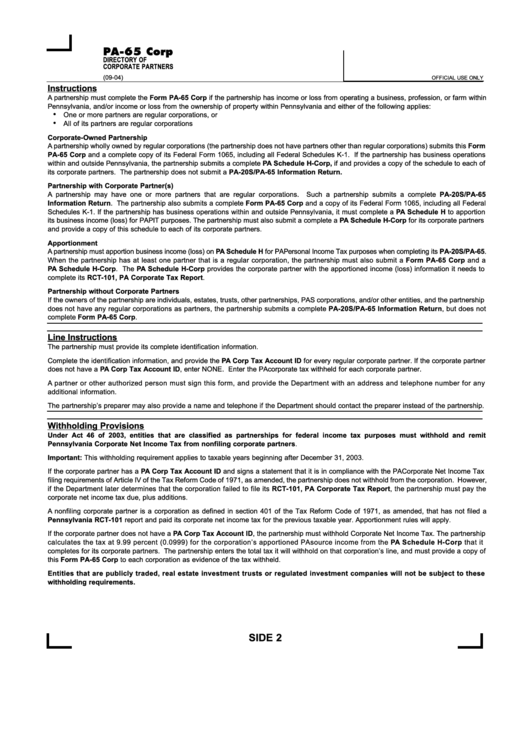

PA-65 Corp

DIRECTORY OF

CORPORATE PARTNERS

(09-04)

OFFICIAL USE ONLY

Instructions

A partnership must complete the Form PA-65 Corp if the partnership has income or loss from operating a business, profession, or farm within

Pennsylvania, and/or income or loss from the ownership of property within Pennsylvania and either of the following applies:

•

One or more partners are regular corporations, or

•

All of its partners are regular corporations

Corporate-Owned Partnership

A partnership wholly owned by regular corporations (the partnership does not have partners other than regular corporations) submits this Form

PA-65 Corp and a complete copy of its Federal Form 1065, including all Federal Schedules K-1. If the partnership has business operations

within and outside Pennsylvania, the partnership submits a complete PA Schedule H-Corp, if and provides a copy of the schedule to each of

its corporate partners. The partnership does not submit a PA-20S/PA-65 Information Return.

Partnership with Corporate Partner(s)

A partnership may have one or more partners that are regular corporations.

Such a partnership submits a complete PA-20S/PA-65

Information Return. The partnership also submits a complete Form PA-65 Corp and a copy of its Federal Form 1065, including all Federal

Schedules K-1. If the partnership has business operations within and outside Pennsylvania, it must complete a PA Schedule H to apportion

its business income (loss) for PA PIT purposes. The partnership must also submit a complete a PA Schedule H-Corp for its corporate partners

and provide a copy of this schedule to each of its corporate partners.

Apportionment

A partnership must apportion business income (loss) on PA Schedule H for PA Personal Income Tax purposes when completing its PA-20S/PA-65.

When the partnership has at least one partner that is a regular corporation, the partnership must also submit a Form PA-65 Corp and a

PA Schedule H-Corp. The PA Schedule H-Corp provides the corporate partner with the apportioned income (loss) information it needs to

complete its RCT-101, PA Corporate Tax Report.

Partnership without Corporate Partners

If the owners of the partnership are individuals, estates, trusts, other partnerships, PA S corporations, and/or other entities, and the partnership

does not have any regular corporations as partners, the partnership submits a complete PA-20S/PA-65 Information Return, but does not

complete Form PA-65 Corp.

Line Instructions

The partnership must provide its complete identification information.

Complete the identification information, and provide the PA Corp Tax Account ID for every regular corporate partner. If the corporate partner

does not have a PA Corp Tax Account ID, enter NONE. Enter the PA corporate tax withheld for each corporate partner.

A partner or other authorized person must sign this form, and provide the Department with an address and telephone number for any

additional information.

The partnership’s preparer may also provide a name and telephone if the Department should contact the preparer instead of the partnership.

Withholding Provisions

Under Act 46 of 2003, entities that are classified as partnerships for federal income tax purposes must withhold and remit

Pennsylvania Corporate Net Income Tax from nonfiling corporate partners.

Important: This withholding requirement applies to taxable years beginning after December 31, 2003.

If the corporate partner has a PA Corp Tax Account ID and signs a statement that it is in compliance with the PA Corporate Net Income Tax

filing requirements of Article IV of the Tax Reform Code of 1971, as amended, the partnership does not withhold from the corporation. However,

if the Department later determines that the corporation failed to file its RCT-101, PA Corporate Tax Report, the partnership must pay the

corporate net income tax due, plus additions.

A nonfiling corporate partner is a corporation as defined in section 401 of the Tax Reform Code of 1971, as amended, that has not filed a

Pennsylvania RCT-101 report and paid its corporate net income tax for the previous taxable year. Apportionment rules will apply.

If the corporate partner does not have a PA Corp Tax Account ID, the partnership must withhold Corporate Net Income Tax. The partnership

calculates the tax at 9.99 percent (0.0999) for the corporation’s apportioned PA source income from the PA Schedule H-Corp that it

completes for its corporate partners. The partnership enters the total tax it will withhold on that corporation’s line, and must provide a copy of

this Form PA-65 Corp to each corporation as evidence of the tax withheld.

Entities that are publicly traded, real estate investment trusts or regulated investment companies will not be subject to these

withholding requirements.

SIDE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1